Kathmandu, Oct 8: Typically, the first six months after the end of a fiscal year (2081/82 BS) mark the main dividend declaration period for NEPSE listed companies. As most companies hold their annual general meetings (AGMs) before mid-January (Poush end), investors often analyze the fourth-quarter financial reports before deciding where to invest.

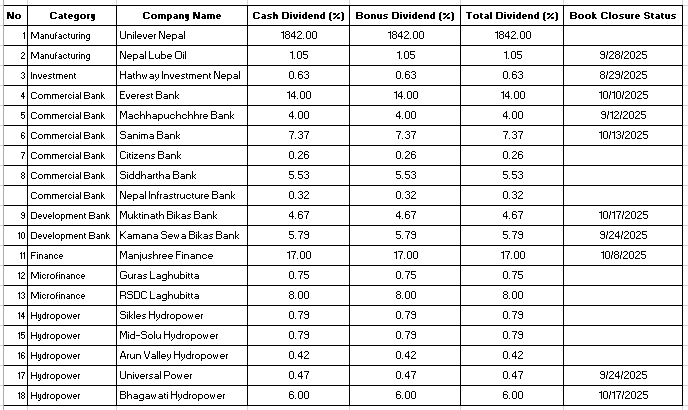

So far, 19 listed companies have announced dividends from their retained earnings of the last fiscal year. These companies have allocated a portion of their profits for dividend distribution. Among them, 10 companies have already set book closure dates, while 6 companies’ book closure periods have expired.

Investors can still receive dividends if they buy shares of Everest Bank, Sanima Bank, Bhagawati Hydropower, and Muktinath Bikas Bank before their respective book closure dates. For companies that haven’t yet announced book closure dates, buying shares now also secures dividend eligibility. However, shares of Hathway Investment, Machhapuchchhre Bank, Universal Power, Kamana Sewa Bikas Bank, Nepal Lube Oil, and Manjushree Finance are no longer eligible for dividends, as their book closure dates have passed.

So far, the dividend announcements cover five commercial banks, five hydropower companies, two development banks, two investment companies, two manufacturing firms, two microfinance institutions, and one finance company.

Among high dividend payers, following Unilever, Nepal Lube Oil declared the second-highest total dividend — 1.053% cash and 20% bonus shares, totaling 21.053%. The company has a pending right-share issuance proposal in a 1:2 ratio with SEBON.

Among banks, Everest Bank tops the list, declaring 14% cash and 6% bonus shares, totaling 20%. Machhapuchchhre Bank proposed 4% cash and 4% bonus shares (8% total). Sanima Bank announced 7.37% cash dividend, while Citizens Bank declared 5% bonus shares and 0.26% cash, totaling 5.26%. Siddhartha Bank recently proposed 5% bonus shares and 5.26% cash, amounting to 10.56%.

Among development banks, Muktinath Bikas Bank announced 4.67% cash and 13.53% bonus shares (total 18.20%), while Kamana Sewa Bikas Bank proposed 5.79% cash and 10% bonus shares (total 15.79%).

Manjushree Finance, the only finance company so far, declared a 15% cash dividend.

In the microfinance category, Guras Laghubitta announced 14.25% bonus shares and 0.75% cash (for tax purposes), while RSDC Laghubitta declared 8% cash dividend.

Among hydropower companies, most have announced bonus shares with small cash components to cover tax liabilities.

Sikles Hydropower and Mid-Solu Hydropower declared 0.789% cash and 15% bonus shares (total 15.789%)

Arun Valley Hydropower announced 8% bonus and 0.42% cash (total 8.42%)

Universal Power Company declared 9% bonus and 0.47% cash (total 9.47%)

Bhagawati Hydropower topped the hydropower segment with 14% bonus and 6% cash dividends (total 20%)

While most companies have already finalized their AGMs and book closure dates, investors still have opportunities to qualify for dividends in a few select stocks before their deadlines.