Kathmandu, Dec 8: In recent times, foreign exchange rates have been rising. According to experts, this rise has brought more losses than benefits to Nepal.

Although sectors such as tourism and remittance benefit when foreign exchange rates increase, Nepal’s overall cost rises when importing goods, machinery, and technology, says former Executive Director of Nepal Rastra Bank, Nar Bahadur Thapa. According to him, the value of a currency is determined by the strength of the economy and the sentiment of the general public. Even though Nepal’s economy has been gradually strengthening, the current situation, he says, is one where losses outweigh the benefits.

A stronger foreign currency also creates difficulties for countries burdened with external debt. The budget allocates a certain amount for debt servicing, but a weaker domestic currency raises the repayment burden, creating risks that the allocated amount may prove insufficient, ultimately affecting the national budget, he explained.

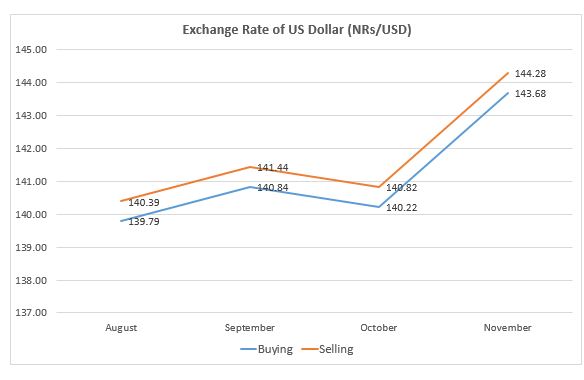

According to a report published by Nepal Rastra Bank (NRB) on November, 2025, Nepalese currency vis-à-vis the US dollar depreciated 2.3 percent in mid-October 2025 from mid-July 2025. It had depreciated 0.6 percent in the same period of the previous year. The buying exchange rate per US dollar stood at Rs.140.22 in mid-October 2025 compared to Rs.137 in mid-July 2025.

Below is an excerpt from a conversation between News Agency Nepal and former Executive Director Thapa regarding the determination of foreign exchange rates, recent fluctuations, and their impacts:

How is the value of a currency determined?

The value of a currency is determined by the strength of the economy and the sentiment of the general public. Our economy is gradually strengthening. Just as the share market fluctuates based on investor sentiment, the value of a currency also rises and falls depending on the sentiment of citizens, importers, and exporters.

Who benefits when the currency value increases?

When currency values fluctuate, there are both costs and benefits. Someone has to bear the additional cost, and someone gains from it. In Nepal’s context, if the dollar becomes stronger, the tourism sector gains. Nepal becomes a cheaper destination for foreign visitors, encouraging more tourists to come, which benefits the tourism industry.

Similarly, exporters benefit when the exchange rate rises. If an export previously earned Rs 140 per dollar, today they receive Rs 144—giving them a profit of Rs 4. Migrant workers who send remittances also benefit: if their families previously received Rs 140 per dollar, they now receive Rs 144. Therefore, a stronger foreign currency benefits tourism, exporters, and Nepalis sending remittances home.

What types of losses does Nepal face when the currency value increases?

A rise in foreign currency value also results in losses. Our import-dependent economy brings in essential industrial raw materials, advanced machinery, and technology. When the Nepali currency weakens, the cost of studying abroad also rises. Moreover, Nepal has external debt—nearly 22 percent of GDP. Interest and principal payments must be made. If the budget was planned based on earlier exchange rates, a sudden rise in the dollar makes repayments costlier. The allocated budget may fall short, affecting overall fiscal management. A weaker Nepali currency forces the government to allocate more funds for external debt servicing. Without sufficient budgetary provisions, this becomes problematic.

Higher exchange rates negatively affect the national budget, increase the cost of petroleum imports, and raise the price of industrial raw materials. Nepal lacks strong export capacity. Remittances account for 28 percent of GDP, and domestic employment is heavily tied to remittance inflows; therefore, the overall benefits remain limited.

If Nepal had strong export capacity, the rise of the dollar from Rs 140 to Rs 144 would have brought substantial national benefits by boosting employment and production. But Nepal’s production capacity remains very weak. Although export-to-GDP ratios appear to be around 4.5 percent, the actual figure is closer to 2.7 percent—the higher figure is inflated due to re-export of imported soybean oil to India. Therefore, Nepal has not been able to realize the theoretical advantages of a stronger dollar. #nepal #exchange #NRB #bullion News Agency Nepal (NNA)