Bigyan Adhikari

Kathmandu, Nov 21: Liquidity refers to the ability of economic assets to be converted into cash quickly and without loss of value. It is essential not only for individuals but also for organizations and the state. Without adequate liquidity, individuals cannot meet basic needs, organizations cannot pay salaries or operating expenses, and the state cannot deliver public services or run its administrative functions.

Governments manage liquidity through revenue collection, borrowing, and grants. Nepal relies on both internal and external debt—currently totaling around NRs 2.7 trillion—to address budget gaps and implement development programs. A significant portion of the national budget is allocated to servicing these debts.

Liquidity constraints affect the private sector as well. Nepal has experienced periodic liquidity shortages in banks and financial institutions. During such episodes, institutions raise interest rates, introduce new deposit schemes, and offer incentives—such as higher returns on remittance deposits—to attract funds. Their objective is to increase deposits, support lending, and maintain financial stability.

When banks lack liquidity, their ability to invest and generate income diminishes, increasing the risk of financial distress. Effective liquidity management is therefore crucial for both the public and private sectors to ensure smooth economic functioning.

The current situation appears different. Total deposits in banks and financial institutions exceed Rs 7.5 trillion, of which Rs 1.139 trillion is readily available for lending. However, due to the lack of credit flow, these funds remain idle. Bank interest rates have declined and converged to a single point. Yet, even under these favorable conditions, industrialists and entrepreneurs are not encouraged to take loans. One reason is the prevailing political fluidity; frequent and abrupt changes in public policy make businesses uncertain about the future.

On the other hand, market demand has not increased. If produced goods do not find consumption in the market, why would producers manufacture them? Currently, industries are operating at only 40% of their capacity, struggling even to meet operational expenses. Interest rates on term deposits and savings have fallen, which automatically reduces loan interest rates. Lower interest rates should create greater investment opportunities, yet investment has not increased. The failure to stimulate investment even under favorable conditions indicates that the economy is not on the right path.

Liquidity in any organization is akin to blood circulation in the human body—without it, death occurs. Similarly, without capital, an organization cannot function. Wise investors must manage liquidity effectively, and some have done so. Presently, the excess liquidity has not been managed appropriately, creating economic challenges. Despite introducing various legal and policy reforms to boost investment, significant improvement has not occurred.

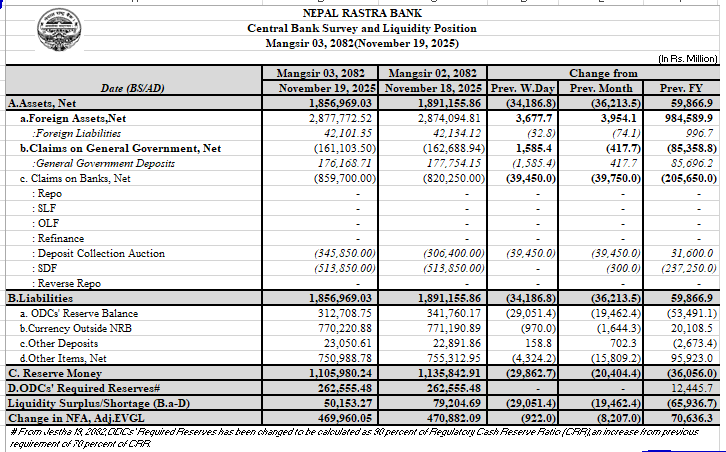

The accumulation of liquidity in banks and financial institutions, coupled with low expenditure in the capital budget, has also affected liquidity management. The economy primarily relies on both public and private sectors. When the public sector is unable to spend, funds remain idle; when banks and financial institutions cannot invest, the Nepal Rastra Bank has to absorb the surplus. Such a situation reflects a failure to maintain balanced liquidity management.

Investment has not increased due to the lack of good governance and trust, administrative complexities, corruption, and delays. Without increased investment, production growth has not been achieved. Merely creating the basis for investment does not guarantee its rise; the key factor is boosting the confidence and sentiment of entrepreneurs. At present, the morale of industrialists and businesspersons remains low.

Liquidity cannot be managed without increasing investment. Currently, the environment is not conducive to investment. During the recent Gen Z movement, government and private property were damaged or destroyed. In an already constrained investment scenario, such disruptions acted like adding fuel to the fire. Under the current circumstances, the economy faces the risk of contraction rather than growth. A weak domestic economy also limits the potential for foreign investment. Factors such as Nepal being placed on the “grey list,” political instability, and civil movements have further affected economic activity.

At present, public attention is focused on the House of Representatives election scheduled for Falgun 21 (March 5, 2026), which further reduces the likelihood of economic dynamism. Private sector confidence has also been shaken by the economic losses caused by the Gen Z movement. If the government fails to address these challenges, a favorable investment climate is unlikely to emerge. Natural disasters, such as floods and continuous rainfall, have also affected investment by disrupting supply chains and limiting credit demand. Even remittances from abroad have not been effectively channeled into productive investment, as 68% of total remittances are consumed rather than invested. Had these funds been directed toward productive sectors, liquidity could have been partially stabilized.

Some improvement is visible in the trade sector compared to the production sector, as trade can generate short-term profits. This has resulted in a limited flow of investment toward trade. Industrialists engaged in production are likely to increase investment once the industrial environment improves, which could help stabilize the current excess liquidity.

The economy experiences cycles of liquidity shortage and excess because policies and economic momentum are not effectively managed. Excess liquidity is easier to manage than scarcity. It is essential to identify why entrepreneurs are reluctant to take loans and address their specific needs. Balanced management of the current excess liquidity is crucial, particularly by central economic institutions such as the Ministry of Finance and the Nepal Rastra Bank. #nepal #liquidity #nrb