Hong Kong, 18 Nov: Fitch Ratings has affirmed Nepal’s Long-Term Foreign-Currency Issuer Default Rating (IDR) at ‘BB-‘ with a Stable Outlook.

A full list of rating actions is at the end of this rating action commentary.

Key Rating Drivers

Low Debt, Lagging Structural Features: Nepal’s ‘BB-‘ rating reflects its low and highly concessional government and external debt burdens, strong external liquidity and solid medium-term growth prospects anchored by the hydropower sector. The rating is constrained by an underdeveloped economy that is vulnerable to external shocks and natural disasters, and weaker structural features, such as GDP per capita and governance metrics, than ‘BB’ category peers.

Heightened Political Uncertainty: Nepal’s political outlook remains uncertain despite the quick de-escalation of youth-led unrest in early September 2025, triggered by a social media ban amid public discontent over corruption, inequality and limited job opportunities. The interim government installed on 12 September has restored calm and announced elections for 5 March 2026, but delays in the political transition and a more fragmented party landscape could undermine policymaking effectiveness and further weaken governance standards.

The sovereign’s credit strengths, underpinned by successful IMF programme implementation, have provided resilience to recent social unrest that overthrew the government. However, lingering political uncertainty would increase risks to the economic and fiscal outlook and lead to pressure on the sovereign’s credit profile over time.

Wider Budget Deficits, Slow Consolidation: We project the federal (central) government deficit will widen to 3.5% of GDP in the fiscal year ending 15 July 2026 (FY26), above the 3.0% projected ‘BB’ median and 1.7% estimated in FY25. This reflects weaker revenue collection from a subdued private sector and stepped-up government spending on reconstruction and elections. Damage from the unrest is about NPR80 billion (1.2% of projected FY26 GDP), as per the preliminary estimates from the interim government. We expect the deficit to slip to 3.4% in FY27 (BB median: 2.8%) due to stronger revenue gains from economic recovery and higher imports, offsetting better capex execution.

Government Debt Ratio to Stabilise: Fitch forecasts a moderate increase in federal government debt to 46.1% of GDP in FY26 from an estimated 43.8% in FY25 on wider fiscal deficits. The debt ratio will remain below the projected ‘BB’ median of 54.4%. Our baseline expects the debt ratio will hover around 46% in FY29, assuming no material shift in the fiscal policy framework under a post-election government and a continued recovery in growth to its potential level of around 5%. Government guaranteed debt remains low at roughly 1% of GDP. Local and provincial governments currently have no debt.

Resilient Debt Structure Features: Our baseline assumes the government will maintain solid access to multilateral and bilateral financing despite elevated political uncertainty, underpinned by constructive engagement with the IMF. The government external debt stock (23% of GDP in FY25) is on highly concessional terms, with an average maturity of 13 years and an average interest rate of about 1%. Domestic financing is supported by ample banking-sector liquidity, driven by buoyant remittances, lowered policy rates, and capital controls. Non-residents hold no government domestic debt, which stood at 21% of GDP, with average maturity under three years.

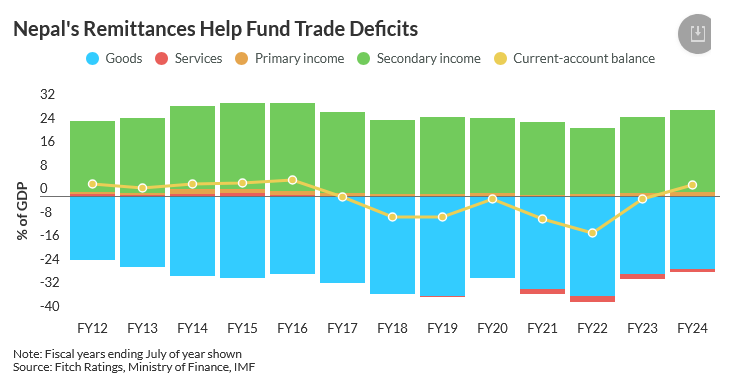

External Surplus to Decline: We forecast the current account (CA) surplus will narrow to 2.4% of GDP in FY26 from 6.7% in FY25, reflecting a notable decline in tourism receipts and a moderate pickup in imports tied to reconstruction and energy projects. We expect remittances (about 28% of GDP) to remain resilient amid political uncertainty due to strong emigration, which should help cushion the economic impact of the social unrest. We expect the CA will flip to a modest deficit of 1.2% in FY27, as import growth gains further traction.

Robust External Liquidity: Nepal’s foreign-exchange reserve coverage increased to 13.5 months of current external payments in FY25, well above the ‘BB’ peer median of 4.8 months. We expect the reserves to continue providing a substantial liquidity buffer against external vulnerabilities and support the longstanding Indian rupee peg. Nepal maintained a net external creditor position of 13.5% of GDP in FY25, in contrast to the ‘BB’ median debtor position of about 12%.

Near-Term Growth Headwinds: Fitch forecasts Nepal’s real GDP growth to slow to 2.5% in FY26 from 4.6% in FY25. We believe the recent unrest has disrupted economic activity, weakened consumer and business sentiment, and depressed private investment and tourist inflows. The agriculture sector (25% of GDP) was, moreover, hit by erratic rains and flooding during the harvest, adding to the near-term headwinds. Major development projects, including in the hydropower sector, have not reported significant disruptions, which should contain the economic fallout.

We see a limited direct impact from global trade tensions, given Nepal’s low reliance on merchandise exports (5% of GDP). Our baseline assumes Nepal’s medium-term growth prospects will be supported by continued investment in hydropower generation and transmission, more reliable electricity supply, and structural reforms to improve the business climate, boost productivity and create jobs.

Financial–Sector Weakness: Bank financial soundness indicators continue to weaken, as the sector works through lingering asset-quality issues stemming from the 2021 credit boom. Non-performing loans rose to 5.2% of gross loans in FY25 from 3.7% in FY24 and could be revised following an IMF-supported loan portfolio review of the 10 largest banks, which the central bank has committed to complete by December 2025. Recent unrest has triggered significant insurance claims, with domestic reinsurers exposed to major losses.

ESG – Governance: Nepal has an ESG Relevance Score of ‘5’ for both Political Stability and Rights and for the Rule of Law, Institutional and Regulatory Quality and Control of Corruption. These scores reflect the high weight that the World Bank Governance Indicators have in our proprietary Sovereign Rating Model. Nepal has a low World Bank Governance Indicator ranking at the 34th percentile.

RATING SENSITIVITIES

Factors that Could, Individually or Collectively, Lead to Negative Rating Action/Downgrade

-Structural Features/Macro: Political instability that would lead to a deterioration in governance standards or cause disruption and a material weakening of medium-term growth prospects.

-Public Finances: Evidence of weakening public finance management, for example, due to substantial political pressures.

-External Finances: A material weakening of bilateral and multilateral creditor support that strains external financing and pressures foreign-exchange reserves, for example, due to slippage on Nepal’s IMF programme.

Factors that Could, Individually or Collectively, Lead to Positive Rating Action/Upgrade

– Macro/Structural Features: Strong, stable economic growth enabling substantial increases in GDP per capita, potentially supported by improved governance standards and regulations conducive to private and foreign investment.

-Public Finances: A material reduction in government debt, for example, due to sustained revenue mobilisation.

Sovereign Rating Model (SRM) and Qualitative Overlay (QO)

Fitch’s proprietary SRM assigns Nepal a score equivalent to a rating of ‘B+’ on the Long-Term Foreign-Currency (LT FC) IDR scale. Fitch’s sovereign rating committee adjusted the output from the SRM to arrive at the final LT FC IDR by applying its QO, relative to SRM data and output, as follows:

– Structural: +1 notch, to adjust for the negative effect on the SRM of Nepal’s take-up of the Debt Service Suspension Initiative, which prompted a reset of the ‘years since default or restructuring event’ variable, which can pertain to both official and commercial debt. In this case, we judged that the deterioration in the model as a result of the reset does not signal a weakening of the sovereign’s capacity or willingness to meet its obligations to private-sector creditors.

Fitch’s SRM is the agency’s proprietary multiple regression rating model that employs 18 variables based on three-year centred averages, including one year of forecasts, to produce a score equivalent to a LT FC IDR. Fitch’s QO is a forward-looking qualitative framework designed to allow for adjustment to the SRM output to assign the final rating, reflecting factors within our criteria that are not fully quantifiable and/or not fully reflected in the SRM.

Debt Instruments: Key Rating Drivers

Fitch does not currently rate any debt instruments for Nepal.

Country Ceiling

The Country Ceiling for Nepal is ‘BB-‘, in line with the Long-Term Foreign-Currency IDR. This reflects no material constraints and incentives, relative to the IDR, against capital or exchange controls being imposed that would prevent or significantly impede the private sector from converting local currency into foreign currency and transferring the proceeds to non-resident creditors to service debt payments.

Fitch’s Country Ceiling Model produced a starting point uplift of +0 notches above the IDR. Fitch’s rating committee did not apply a qualitative adjustment to the model result.

REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING

The principal sources of information used in the analysis are described in the Applicable Criteria.

Climate Vulnerability Signals

The results of our Climate.VS screener did not indicate an elevated risk for Nepal.

ESG Considerations

Nepal has an ESG Relevance Score of ‘5’ for Political Stability and Rights, as World Bank Governance Indicators have the highest weight in Fitch’s SRM and are therefore highly relevant to the rating and a key rating driver with a high weight. As Nepal has a percentile rank below 50 for the respective Governance Indicator, this has a negative impact on the credit profile.

Nepal has an ESG Relevance Score of ‘5’ for Rule of Law, Institutional & Regulatory Quality and Control of Corruption as World Bank Governance Indicators have the highest weight in Fitch’s SRM and are therefore highly relevant to the rating and are a key rating driver with a high weight. As Nepal has a percentile rank below 50 for the respective Governance Indicators, this has a negative impact on the credit profile.

Nepal has an ESG Relevance Score of ‘4’ for Human Rights and Political Freedoms as the Voice and Accountability pillar of the World Bank Governance Indicators is relevant to the rating and a rating driver. As Nepal has a percentile rank below 50 for the respective Governance Indicator, this has a negative impact on the credit profile.

Nepal has an ESG Relevance Score of ‘4’ for Creditor Rights as willingness to service and repay debt is relevant to the rating and is a rating driver for Nepal, as for all sovereigns. Nepal’s recent restructuring of public debt has a negative impact on the credit profile, albeit offset by the QO adjustment.

The highest level of ESG credit relevance is a score of ‘3’, unless otherwise disclosed in this section. A score of ‘3’ means ESG issues are credit-neutral or have only a minimal credit impact on the entity, either due to their nature or the way in which they are being managed by the entity. Fitch’s ESG Relevance Scores are not inputs in the rating process; they are an observation on the relevance and materiality of ESG factors in the rating decision.

(Source: https://www.fitchratings.com/research/sovereigns/fitch-affirms-nepal-at-bb-outlook-stable-18-11-2025)