SYDNEY: Time after time, austerity budgets have provided populist political parties with political openings. In the United Kingdom, France, Poland, and elsewhere, populists have used austerity budget cuts to browbeat “fiscally responsible” governments.

Because of this dynamic, it is hard to believe that Elon Musk thought that US President Donald Trump’s interest in Musk’s Department of Government Efficiency was motivated by a genuine commitment to saving public money.

His sense of betrayal was nevertheless strong enough that he lambasted Trump’s One Big Beautiful Bill Act (OBBBA) – which is forecast to add trillions of dollars to the US federal budget deficit and national debt – as a “disgusting abomination.”

Even Steve Bannon, a key architect of Trump’s populist “Make America Great Again” (MAGA) agenda and Musk’s ideological adversary, has made similar criticisms of the bill, as have prominent Senate Republicans like Rand Paul and Ron Johnson.

Such dissent from the right is unusual. Of course, Republicans have vigorously denounced the spending plans of past Democratic administrations. But when Republican presidents are in power, these affordability concerns instantly vanish.

“Deficits don’t matter,” as former US Vice President Dick Cheney, the principal architect of the Iraq War, famously put it.

While Republicans understand that banging the drumbeat of fiscal austerity is a political instrument, Democrats have been more earnest – or naive – about its virtues. True, there is good political reason to join Republican dissenters in arguing that the bill’s tax cuts for the rich are “unaffordable.”

But history suggests that the Democratic Party may soon lose sight of the strategic character of such ideological alliances and end up playing an unfortunate role in a twisted morality play authored by the right.

Since Ronald Reagan, every Republican president has dramatically increased the deficit through tax cuts and military spending. By contrast, Democratic administrations have done the work of reining in the country’s growing debt, largely by slashing public investment and weakening the social safety net.

Lawrence H. Summers, who served as Treasury Secretary under President Bill Clinton, was convinced that the economic revival of the 1990s was due to Clinton’s commitment to balancing the budget. As director of President Barack Obama’s National Economic Council, Summers successfully pushed the same approach.

Following a decade of economic stagnation, President Joe Biden’s administration broke from this pattern and tried to rouse the American economy from its pandemic-induced torpor with a massive fiscal stimulus. Summers led a media offensive against the policy, warning of an inflationary surge.

But Biden stuck to his guns, and, although inflation did jump up briefly, no catastrophe unfolded, thanks to the United States’ unique ability to run large budget deficits, owing to the dollar’s centrality in the global financial system. Time and again over the past half-century, America has been able to sustain higher levels of debt than many anticipated.

After Biden bowed out of the 2024 presidential election, the elevation of Kamala Harris, his vice president, to the top of the Democratic ticket signified a possible return to the economic-policy orientation of the Clinton and Obama eras. But Harris lost the race, leaving America – and the world – with Trump, the self-proclaimed “king of debt.”

Given this, it is not surprising that many former Democratic officials have sounded the alarm about Trump’s spending bill. In the New York Times, Peter Orszag, who served as Director of the Office of Management and Budget under Obama, argued that the national debt is now reaching a level that could undermine global investors’ willingness to hold dollar assets. Summers has likewise warned that the OBBBA implies “debt on a massive scale that we can’t afford.”

Of course, any government’s capacity to finance deficits is finite. Former British Prime Minister Liz Truss learned that the hard way in 2022, when her government’s mini-budget triggered a sharp rise in borrowing costs, leading to the swift demise of her premiership. But Trump is not heading for a Truss-like incident.

The dollar is far more critical to the world economy than the pound. And the US Federal Reserve’s commitment to ensuring the liquidity of the Treasury market, in concert with foreign central banks and treasuries, bolsters the greenback’s too-big-to-fail status.

The recent decision by Moody’s to downgrade the US sovereign credit rating was significant. If unrestricted borrowing, coupled with endless tariff uncertainty, fuels inflation and slows growth, more downgrades will follow, making it more expensive for the US government to finance its debts. Although this would have adverse consequences for America, it doesn’t represent an existential threat, which means that Democrats’ calls for fiscal rectitude will not gain traction among Republicans.

The party’s resolve to rebalance the books will, however, influence intraparty debate. Leaders of the Democratic establishment such as Harris, Gavin Newsom, and Rahm Emanuel would fall over one another to reprise the Obama years.

But that era’s institutionalization of the bailout state and prolonged fiscal austerity would push the country into another recession – providing fertile ground for popular discontent and further political polarization.

The US is not alone, of course. Across Europe and elsewhere, governments’ embrace of socialism for the rich and austerity for everyone else has fueled the rise of MAGA-like populist movements. But the fact that so many prominent Republicans are objecting to Trump’s spending bill reflects the hollow ideological core that MAGA shares with other right-wing populist movements. A motley collection of intense grievances does not easily translate into a coherent economic strategy.

Instead, the Democratic Party should focus on building a progressive economic policy platform that can mobilize electoral support. Bidenomics was a good but imperfect start, not a mistake to be regretted. The Democrats – and democrats worldwide – must offer a more appealing vision of the expansive use of the public purse. Otherwise, they may not get their hands back on the levers of fiscal policy for some time to come.

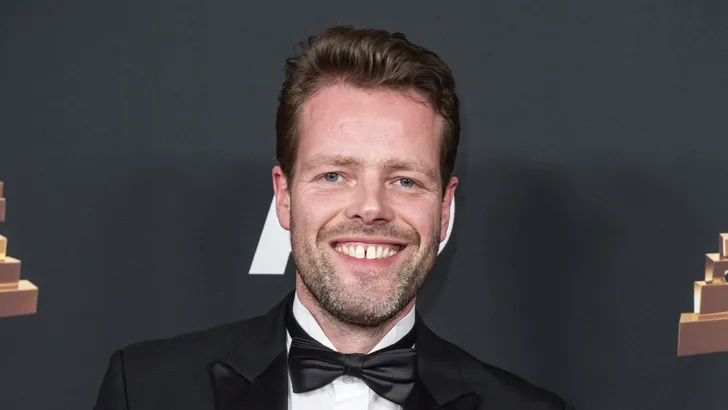

Martijn Konings is Professor of Political Economy and Social Theory at the University of Sydney and the author, most recently, of The Bailout State: Why Governments Rescue Banks, Not People (Polity, 2025).

Copyright: Project Syndicate, 2025.

www.project-syndicate.org