The Covid-19 pandemic and the Ukraine crisis have not only affected the global political alignments and strategic preferences but also negatively hit global economy. The ramifications of these crises affected Nepal as well. Of late, there is a growing apprehension in Nepal that the country’s economy may traverse through a similar path as that of Sri Lanka. The economy which was on the path of recovery following the Covid-19 pandemic was further hit by the Ukraine crisis. This article tries to examine the trajectory of Nepal’s economy in view of the pandemic and the Ukraine crisis.

Following the publication of monthly report of the Nepal Rastra Bank (NRB), the Central Bank of Nepal, titled Current Macroeconomic and Financial Situation of Nepal (based on 7 months’ data ending mid-February, 2021/22), there were growing concerns that Nepalese economy was on the verge of collapse. The report highlighted that based on the imports of 7 months of 2021/22, the foreign exchange reserves of the banking sector was sufficient to cover the prospective merchandise and services imports of 6.7 months.[i] The gross foreign exchange reserves decreased 17 percent to US$9.75 billion in mid-February 2022 from US$11.75 billion in mid-July 2021.[ii] Remittances inflows, which constitute over 20 percent of the GDP, decreased 5.8 percent to US$4.53 billion in the that period against an increase of 6.8 percent in the same period of the previous year.[iii]

Issues Impacting Nepal’s Economy

The International Monetary Fund (IMF) noted that the global economic impact of the war in Ukraine is exacerbating existing vulnerabilities and impacting Nepal’s import-reliant economy, increasing inflation, and decreasing international reserves.[iv] The Ukraine crisis which had led to rise in oil and food prices had a cascading effect on the Nepalese economy. While commenting on Nepal’s international reserves, the IMF acknowledged that “although the reserves currently remain adequate, but declined more than anticipated.”[v] The IMF has recommended monetary tightening and a prudent FY2023 Budget to preserve macroeconomic stability.[vi]

Nepal responded to the falling forex reserves by banning luxury goods import till mid-July 2022[vii] in order to rein in capital outflows.[viii] The Government of Nepal felt that stronger import control was needed in order to maintain a foreign exchange reserve cover at 7 months of imports. Nepal has also availed concessional credit from the IMF as well as the World Bank. The IMF had approved Extended Credit Facility (ECF)[ix] of US$395.9 million to Nepal, in January 2022, to help mitigate the pandemic’s impact on health and economic activity as also to preserve macroeconomic and financial stability.[x] Further, in March 2022, in order to strengthen Nepal’s financial sector, the World Bank agreed to extend US$150 million “Finance for Growth” Development Policy Credit.[xi] A similar package was extended for the second time by the World Bank in May 2022 as well.[xii]

Growth Trajectory and Forex Reserves

The World Bank had estimated the economic growth of Nepal at 1.8 percent for FY2021 and projected an increased growth rate of 3.7 percent for FY2022.[xiii] It may be noted that up to FY2019, Nepal had registered over 6 percent growth for three consecutive years. The average growth rate over the period of FY2009–19 stood at 4.9 percent. At the beginning of the pandemic, Nepal had accumulated substantial foreign exchange reserves, primarily due to both a fall in imports and new concessional loan disbursements.[xiv] With increasing imports outpacing foreign currency earnings during the recovery phase, Nepal used its reserves to finance imports. According to the latest World Bank figures, Nepal is estimated to grow at 5.1 percent in FY2023 and 4.9 percent in FY2024.[xv]

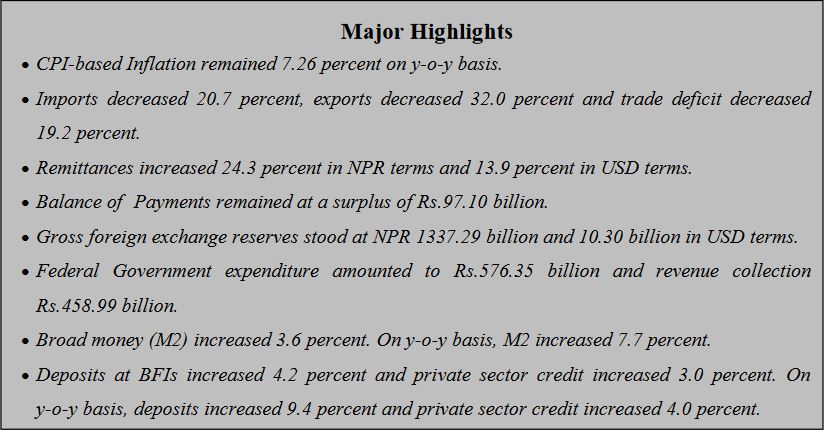

In its latest monthly report, the NRB has stated that the forex reserves, which was at US$9.54 billion in mid-July 2022, increased by 1 percent to US$9.63 billion in mid-November 2022.[xvi] The report stated that based on the imports of four months of 2022/23, the foreign exchange reserves of the banking sector is sufficient to cover the prospective merchandise and services imports of 8.4 months.[xvii] This is above the optimal level of 5.5 months recommended by the IMF and also above the Central Bank benchmark of maintaining at least 7 months of import cover. Similarly, remittance inflows increased by 10.8 percent to US$2.93 billion in the review period against a decrease of 7.3 percent in the same period of the previous year.[xviii] Therefore, with increase in remittances[xix] and spurt in tourism[xx] the forex reserve is expected to increase further.

Conclusion

The economic situation in Nepal is not as alarming as some perceive it to be, although Kathmandu needs to be cautious going ahead. With regard to foreign exchange reserves, Nepal is better placed than Sri Lanka (which had defaulted on debt[xxi]) as well as Pakistan (which had US$6.7 billion of foreign exchange reserves by December 2022, equivalent to 1 month of imports[xxii]). On a positive note, Nepal qualified to graduate from the LDC (Least Developed Country) category to a developing country. During the 40th plenary of the 76th session of the United Nations General Assembly (UNGA), Nepal qualified to graduate from the LDC category to a developing country.[xxiii] To graduate to developing country category, Nepal needs to maintain robust economic growth in the next few years. With the World Bank, in its report Global Economic Prospects predicting that global economy is entering what could become a protracted period of feeble growth and elevated inflation,[xxiv] Nepal may require to undertake corrective measures to firm up the economy. Despite encouraging signs of recovery, Nepal needs to carefully sequence corrective economic measures in order to avoid shocks in the days ahead. It remains to be seen how Nepal, with a newly formed government, would tackle the challenges ahead and safeguard macroeconomic stability.

*****

*Dr. Naresh B. K., Research Fellow, Indian Council of World Affairs, New Delhi.

Disclaimer: The views expressed are personal.

Source: Indian Council of World Affairs

Endnotes

[i] Nepal Rastra Bank, Current Macroeconomic and Financial Situation of Nepal, March 11, 2022, available at: https://www.nrb.org.np/contents/uploads/2022/03/Current-Macroeconomic-and-Financial-Situation-English-Based-on-Seven-Months-data-of-2021.22.pdf (Accessed on April 08, 2022).

[ii] Ibid.

[iii] Ibid.

[iv] International Monetary Fund, “Statement at the Conclusion of IMF Mission to Nepal”, May 04, 2022, available at: https://www.imf.org/en/News/Articles/2022/05/03/pr22139-nepal-statement-at-the-conclusion-of-imf-mission (Accessed on May 12, 2022).

[v] Ibid.

[vi] Ibid.

[vii] Gopal Sharma, “IMF Urges Nepal to Tighten Monetary Policy to Bolster Forex Reserves”, Reuters, May 04, 2022, available at: https://www.reuters.com/world/asia-pacific/imf-favours-monetary-tightening-contain-nepals-falling-forex-reserves-2022-05-04/ (Accessed on May 21, 2022).

[viii] The ban was subsequently lifted on December 06, 2022. “Bowing to the pressure of private sector, govt decides lifting ban on imports of luxury goods”, MyRepublica, December 06, 2022, available at: https://myrepublica.nagariknetwork.com/news/bowing-to-the-pressure-of-private-sector-govt-decides-lifting-ban-on-imports-of-luxury-goods/ (Accessed on December 22, 2022).

[ix] The Extended Credit Facility (ECF) provides financial assistance to countries with protracted balance of payments problems.

[x] International Monetary Fund, “IMF Executive Board Approves US$395.9 Million ECF Arrangement for Nepal”, January 13, 2022, available at: https://www.imf.org/en/News/Articles/2022/01/13/pr2206-nepal-imf-executive-board-approves-us-million-ecf-arrangement (Accessed on June 11, 2022).

[xi] The World Bank, “World Bank Provides $150 Million to Strengthen Nepal’s Financial Sector for Green, Resilient, and Inclusive Development”, March 24, 2022, available at: https://www.worldbank.org/en/news/press-release/2022/03/23/world-bank-provides-150-million-to-strengthen-nepal-s-financial-sector-for-green-resilient-and-inclusive-development (Accessed on May 11, 2022).

[xii] The World Bank, “Government of Nepal and World Bank Sign $150 Million Development Policy Credit to Strengthen Nepal’s Financial Sector”, May 03, 2022, available at: https://www.worldbank.org/en/news/press-release/2022/05/03/government-of-nepal-and-world-bank-sign-150-million-development-policy-credit-to-strengthen-nepal-s-financial-sector (Accessed on May 11, 2022).

[xiii] The World Bank, Global Economic Prospects: South Asia Region, June 2022, available at: https://thedocs.worldbank.org/en/doc/18ad707266f7740bced755498ae0307a-0350012022/related/Global-Economic-Prospects-June-2022-Regional-Highlights-SAR.pdf (Accessed on June 08, 2022).

[xiv] The World Bank. “Nepal Overview”, October 2022, available at: https://www.worldbank.org/en/country/nepal/overview (Accessed on December 21, 2022).

[xv] Ibid.

[xvi] Nepal Rastra Bank, Current Macroeconomic and Financial Situation of Nepal, December 15, 2022, available at: https://www.nrb.org.np/contents/uploads/2022/12/Current-Macroeconomic-and-Financial-Situation-English-Based-on-Four-Months-data-of-2022.23-1.pdf (Accessed on December 21, 2022).

[xvii] Ibid.

[xviii] Ibid.

[xix] The World Bank in its report, “Remittances Brave Global Headwinds”, estimated that in 2022 contribution of remittances to the GDP projected to rise to 22 percent. The World Bank, Remittances Brave Global Headwinds, November 2022, available at: https://www.knomad.org/sites/default/files/publication-doc/migration_and_development_brief_37_nov_2022.pdf (Accessed on December 30, 2022).

[xx] In June 2022, The World Bank estimated that the tourism industry contributed about 6.7 percent of the GDP. The World Bank, “Harnessing Tourism to Enhance the Value of Biodiversity and Promote Conservation in Nepal”, June 03, 2022, available at: https://www.worldbank.org/en/news/feature/2022/06/03/harnessing-tourism-to-enhance-the-value-of-biodiversity-and-promote-conservation-in-nepal (Accessed on December 30, 2022).

[xxi]Peter Hoskins, “Sri Lanka Defaults on Debt for First Time in its History”, BBC, May 20, 2022, available at: https://www.bbc.com/news/business-61505842 (Accessed on May 30, 2022).

[xxii]The World Bank, “Pakistan: Overview”, last updated on April 08, 2022, available at: https://www.worldbank.org/en/country/pakistan/overview#1 (Accessed on May 30, 2022). Pakistan’s forex reserves had further declined to US$6.7 billion equivalent to one month of import cover. Gibran Naiyyar Peshimam, “Pakistan FX reserves held by central bank fall to $6.7 bln”, December 08, 2022, available at: https://www.reuters.com/markets/asia/pakistan-fx-reserves-held-by-central-bank-fall-67-bln-dec-2-2022-12-08/ (Accessed on December 30, 2022).

[xxiii] United Nations General Assembly, “Graduation of Bangladesh, the Lao People’s Democratic Republic and Nepal from the least developed country category”, November 11, 2021, available at: https://documents-dds-ny.un.org/doc/UNDOC/LTD/N21/332/88/PDF/N2133288.pdf?OpenElement (Accessed on December 21, 2022).

[xxiv] The World Bank, Global Economic Prospects, June 2022, available at: https://www.worldbank.org/en/publication/global-economic-prospects (Accessed on June 08, 2022).