Kathmandu, May 29: The government has increased the tax on electric vehicles (EV). The excise and customs rates for EV have been changed.

Finance Minister Barshaman Pun has increased the tax on EVs in the economic bill presented in Parliament on Tuesday.

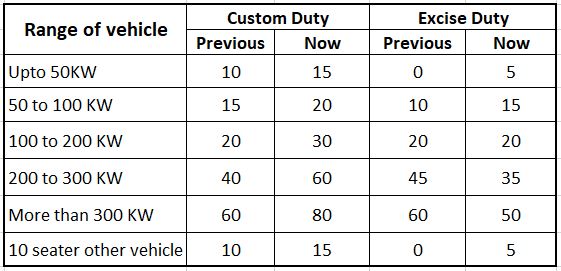

The customs duty has been increased from 10 to 15 percent on unassembled and other 10-seater EVs. Excise duty on the same types of EVs will also be levied at 5 percent on both unassembled and other types. Excise duty was not levied on it earlier.

Customs duty has also been increased on EVs with motors up to 50 kW and excise duty will be levied. The customs duty of 10 percent on EVs with this motor capacity has been increased to 15 percent.

5 percent excise duty will also be levied on EVs with a capacity of up to 50 KW. Excise duty was not levied earlier.

Customs duty and excise duty on EVs with motor capacity of 50 to 100 kW have been increased by 5 percent. Since there is a system of not charging unassembled excise duty on EVs of that capacity, now it will be charged at 15 percent. As the excise duty on other EVs of the same capacity reached 15% from 10%, the duty on both unassembled and others of the said capacity has been increased from 15% to 20%.

While customs duty has increased by 10 percent on EVs with a capacity of 100 to 200 KW, the excise duty has been kept unchanged. Even though excise duty was not charged on unassembled EVs of the said motor capacity, 20 percent will be levied now, while the excise duty on those imported after preparation remains unchanged at 20 percent.

However, the customs duty for EVs with 100 to 200 kW motor capacity has increased from 20 to 30 percent. The increased customs duty is for both unassembled and others.

Excise duty has decreased as the duty of more than 200 kW has increased

Due to the increase in customs duty on EVs with a motor capacity of more than 200 kW, the excise duty has decreased. In both unassembled and other types of EVs with this motor capacity, the customs duty has increased by 20 percentage points from 40 percent to 60 percent, while the excise duty has decreased by 10 percentage points.

The excise duty on unassembled EVs of the said capacity is zero, but now it will be 35 percent, while on others, it is 45 percent, and the excise duty has been reduced to 35 percent.

Even on EVs with a motor capacity of more than 300 kW, the customs duty has been increased by 20 percentage points, while the excise duty has decreased by 10 percentage points.

While the customs duty of EVs with motor capacity has been increased from 60 to 80 percent, the excise duty has decreased from 60 to 50 percent. Under the current system of not charging excise duty if it is unassembled, now 50 percent excise duty will be charged on it as well.

The government is also going to impose excise duty on EVs that transport goods.