Kathmandu, July 24: In line with conditions set by the International Monetary Fund (IMF) for extended lending to Nepal, the Nepal Rastra Bank (NRB), the central bank of Nepal, has finalized the process for an extensive asset quality review of 10 commercial banks.

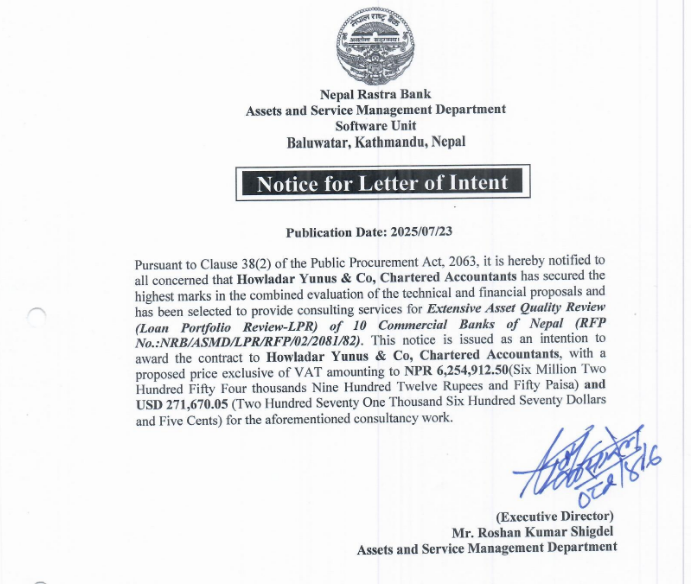

The Nepal Rastra Bank (NRB) has selected Howladar Yunus & Company, an audit firm based in Bangladesh, to conduct the audit. The NRB’s Assets and Service Management Department has published a “notice for letter of intent” to this regard.

Previously, NRB shortlisted six international audit firms, including Deloitte Partners (Sri Lanka), Howladar Yunus & Company (Bangladesh), KPMG Assurance & Consulting Services (India), JV: Mehra-JKSS-SSBDI-JV (Nepal-India), MSKA & Associates (India) and JV: RBA & B.K. Agrawal & Company (Nepal-India).

With the financial proposal now accepted, NRB has opened a seven-day window for any objections or challenges. If no disputes arise during this period, Howladar will begin the full audit of the 10 selected banks.

The audit fee has been fixed as NRs. 6,254,912 and US$ 271,670.

The selection of banks was reportedly based on loan volume and default risk, as NRB suspects poor asset quality in some institutions. The audit will not be limited to loans but will involve a comprehensive review of financial records of the selected commercial banks.

Priority has been given to banks with weaker asset quality and those not following prudent banking practices, particularly in relation to international banking standards.

The IMF had expressed skepticism over the reported size of non-performing loans (NPLs) in Nepal’s banking sector, suspecting loan evergreening practices. To address this concern, the IMF had urged NRB to implement a working capital loan guideline, which adds further regulatory pressure. #nepal #NRB #audit