KATHMANDU: Nepal Rastra Bank (NRB) on Wednesday unveiled the five-month financial position of the current fiscal year 2020/21, stating that the remittance inflow was Rs 416 billion. This is an increase of about 11 percent compared to the same period last year.

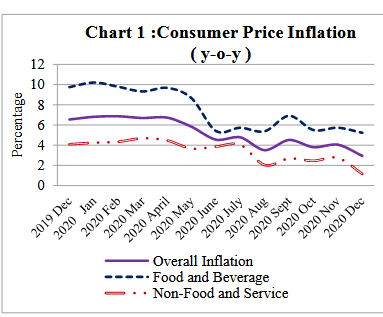

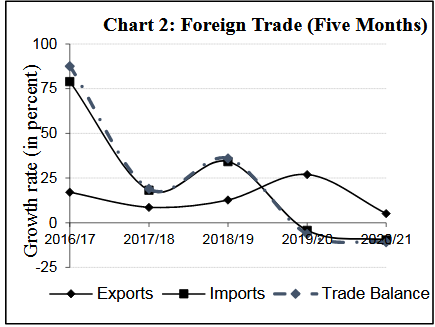

According to the bank, on a year-on-year basis, consumer price index-based inflation stood at 2.93 percent, while imports declined by 9.6 percent and exports increased by 5.1 percent.

The bank said, “Exports have reached Rs 50.06 billion in the last five months. On a destination basis, exports to India and other countries increased by 8.6 percent and 0.8 percent, respectively, while exports to China declined by 55.2 percent. On commodity basis, exports of cardamom, jute-based goods, yarn (polyester and other), noodles, pashmina and other commodities have increased while exports of palm oil, pulses, zinc sheets, woolen carpets and garments have declined.”

Similarly, the import side has reached Rs. 525.50 billion. Imports from India, China and other countries declined by 1.1 per cent, 24.4 per cent and 20.8 per cent, respectively.

Imports of billets, telecommunication equipment and spare parts, coal and other commodities have increased while imports of petroleum products, aircraft parts, crude palm oil, other machinery and spare parts, means of transportation and spare parts have declined.

According to the bank, exports from dry ports, Biratnagar, Kailali, Tatopani, Kanchanpur and Rasuwa customs offices have increased, while imports from Bhairahawa, Biratnagar, Nepalgunj, Krishnanagar, Kailali and Kanchanpur customs offices have declined.

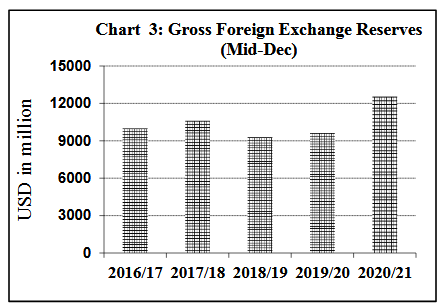

According to the bank, the country’s balance of payments stood at a surplus of Rs. 106.48 billion and total foreign exchange reserves stood at US$ 12.54 billion.

The federal government’s expenditure was Rs. 306.66 billion and revenue mobilization was Rs. 301.23 billion, the bank said.

Money supply have increased by 7.4 percent in this period. The bank said, “Deposits of banks and financial institutions have increased by 6.5 percent and claims against the private sector by 7.9 percent.”

- Major Highlights

- Inflation remained 2.93 percent on y-o-y basis.

- Imports decreased 9.6 percent and exports increased 5.1 percent.

- Remittances increased 10.9 percent in NPR terms and 6.4 percent in USD terms.

- Balance of Payments remained at a surplus of Rs.106.48 billion.

- Gross foreign exchange reserves stood at USD 12.54 billion.

- Federal Government spending amounted to Rs.306.66 billion and revenue collection Rs.301.23 billion.

- Broad money (M2) expanded 7.4 percent. On y-o-y basis, M2 expanded 22.5 percent.

- Deposits at BFIs increased 6.5 percent and claims on private sector increased 7.9 percent. On y-o-y basis, deposits increased 21.6 percent and claims on private sector 13.1 percent.