Kathmandu, Dec 4: Transfer of shares of private telecommunication service-provider company of the country, Ncell Axiata Limited has been courting suspicion since the deal was made public.

After the Malaysian company, Axiata Group Berhad decided to sell 80 per cent of Ncell’s share to another company Spectrlite UK Limited last Friday, the agreement has generated widespread curiosity and concern in Nepal. Questions have been raised about the legal process and financial transparency of this offshore transaction.

Meanwhile, the Parliamentary Public Accounts Committee, Nepal, has also shown interest in the matter of Ncell’s ownership transfer. Committee Secretary Yekram Giri confirmed that the committee has sent a letter to the Inland Revenue Department, Company Registrar’s Office and Nepal Telecommunication Authority with a request for information on Ncell share’s transaction.

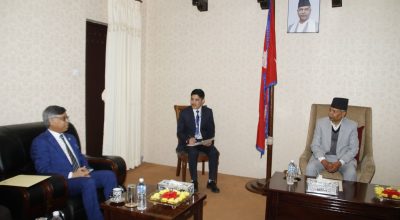

Chairperson of the PAC Rishikesh Pokharel says that the government should respond to the questions being raised by citizens over the matter. “Information has been sought from the relevant agencies on the matter,” said Pokharel.

According to Telecommunication Regulations, 2054 BS, the approval of Nepal Telecommunication Authority must be obtained before buying and selling shares of the telecom company. Similarly, Regulation 4 (a) of Nepal Telecommunications Authority Regulations, 2076 BS also provides that permission or approval of the NTA must be obtained before buying and selling or transferring shares of the shareholder.

The matter has been controversial because the shares were reportedly traded at a very low amount. In 2016, Sweden’s TeliaSonera company sold 80 percent of its shares in Ncell to the Axiata for Rs. 1.365 billion US dollars but the same shares has now been sold for Rs. 50 million US dollars.

Similarly, it is not clear how the provisions related to capital gains tax have been addressed according to the Income Tax Act, 2058 BS. A telecommunications service provider company with a paid-up capital of more than five million rupees should be converted into a public limited company within two years and listed in the Securities Board of Nepal to trade its shares, but Ncell is not listed in the Board yet.

Axiata however has reasoned the shares were sold due to the guarantee of low returns, complicated tax administration, non-cooperation of regulatory bodies, and the government assuming ownership after the license expires.