Kathmandu, July 10: Country received remittance of Rs 1 trillion 112 billion and 52 million in the first eleven months of the current fiscal year.

Nepal Rastra Bank (NRB) presented this data in the Current Macroeconomic and Financial Situation based on the eleven months of the fiscal year 2022-23 (July 17, 2022- July 16, 2023).

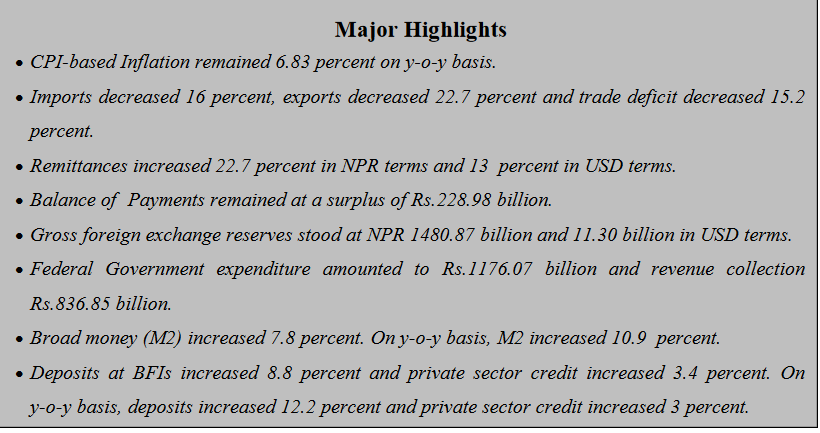

The Central Bank said remittance inflows increased by 22.7 percent to reach Rs 1112.52 billion in the review period compared to an increase of 4.1 percent in the same period of the previous year. In the US Dollar terms, remittance inflows increased 13.0 percent to 8.51 billion in the review period compared to an increase of 1.8 percent in the same period of the previous year.

Similarly, the number of Nepali workers (institutional and individual-new) obtaining approval for foreign employment increased by 46.6 percent and reached 459,415 in the review period. The number of Nepali workers (Renew entry) taking approval for foreign employment increased 0.5 percent to 260,262 in the review period. It had increased 208.3 percent in the same period of the previous year

The data shows that in this period, net transfer soared by 21.9 percent to reach Rs.1229.82 billion. Such a transfer had increased 3.8 percent in the same period of the previous year.

Merchandise Trade

During the eleven months of 2022/23, merchandise exports decreased 22.7 percent to Rs.143.59 billion against an increase of 53.3 percent in the same period of the previous year. Destination-wise, exports to India decreased 32.2 percent whereas exports to China and other countries increased 106.7 percent and 9.9 percent

respectively.

Exports of zinc sheet, particle board, cardamom, woolen carpets, readymade garments, among others, increased whereas exports of soyabean oil, palm oil, oil cakes, textiles, silverware and jewelries, among others, decreased in the review period.

During the eleven months of 2022/23, merchandise imports decreased 16 percent to Rs.1480.98 billion against an increase of 27.5 percent a year ago.

Destination-wise, imports from India, China and other countries decreased 14.8 percent, 17.1 percent and 18.5 percent respectively.

Imports of chemical fertilizer, sponge iron, gold, paper, other stationeries, among others, increased whereas imports of transport equipment & parts, M.S. billet, medicine, crude soyabean oil, other machinery and parts, among others, decreased in the review period.

Based on customs points, exports from Bhairahawa, Dry Port, Jaleshwor, Kailali, Krishnanagar, Mechi, Rasuwa, Tatopani and Tribhuwan Airport Customs Offices increased whereas exports from all the other major customs points decreased in the review period. On the import side, imports from Rasuwa Customs Office increased whereas imports from all the other major customs points decreased in the review period.

Total trade deficit decreased 15.2 percent to Rs.1337.39 billion during the eleven months of 2022/23. Such a deficit had increased 25 percent in the corresponding period of the previous year. The export-import ratio decreased to 9.7 percent in the review period from 10.5 percent in the corresponding period of the previous year.

During the eleven months of 2022/23, merchandise imports from India by paying convertible foreign currency amounted Rs.138.47 billion. Such amount was Rs.200.88 billion in the same period of the previous year.

Current Account and Balance of Payments

The current account remained at a deficit of Rs.69.40 billion in the review period compared to a deficit of Rs.592.14 billion in the same period of the previous year. In the US Dollar terms, the current account registered a deficit of 536.1 million in the review period compared to deficit of 4.93 billion in the same period last year.

In the review period, capital transfer decreased 22.5 percent to Rs.7.35 billion and net foreign direct investment (FDI) recorded Rs.4.65 billion. In the same period of the previous year, capital transfer and net FDI amounted to Rs.9.49 billion and Rs.17.35 billion respectively.

Balance of Payments (BOP) remained at a surplus of Rs.228.98 billion in the review period compared to a deficit of Rs.269.81 billion in the same period of the previous year. In the US Dollar terms, the BOP remained at a surplus of 1.74 billion in the review period against a deficit of 2.26 billion in the same period of the previous year.

Foreign Exchange Reserves

Gross foreign exchange reserves increased 21.8 percent to Rs.1480.87 billion in mid-June 2023 from Rs.1215.80 billion in mid-July 2022. In the US dollar terms, the gross foreign exchange reserves increased 18.5 percent to 11.30 billion in mid-June 2023 from 9.54 billion in mid-July 2022.

Of the total foreign exchange reserves, reserves held by NRB increased 25.1 percent to Rs.1321.25 billion in mid-June 2023 from Rs.1056.39 billion in mid-July

2022. Reserves held by banks and financial institutions (except NRB) increased 0.1 percent to Rs.159.63 billion in mid-June 2023 from Rs.159.41 billion in mid-July 2022. The share of Indian currency in total reserves stood at 22.9 percent in mid-June 2023.

Foreign Exchange Adequacy Indicators

According to NRB data, based on the imports of eleven months of 2022/23, the foreign exchange reserves of the banking sector is sufficient to cover the prospective merchandise imports of 11.2 months and merchandise and services imports of 9.6 months.

The ratio of reserves-to-GDP, reserves-to-imports and reserves-to-M2 stood at 27.5 percent, 80.3 percent and 25.0 percent respectively in mid-June 2023. Such ratios were 24.6 percent, 57.8 percent and 22.1 percent respectively in mid-July 2022.

Full Text

Current Macroeconomic and Financial Situation - English (Based on Eleven Months data of 2022.23)