Kathmandu, Feb 6: Nepal Rastra Bank, the central bank of Nepal, has stated that the economic data has remained positive in many ways, including remittance inflow, surplus in balance of payment and foreign currency reserves.

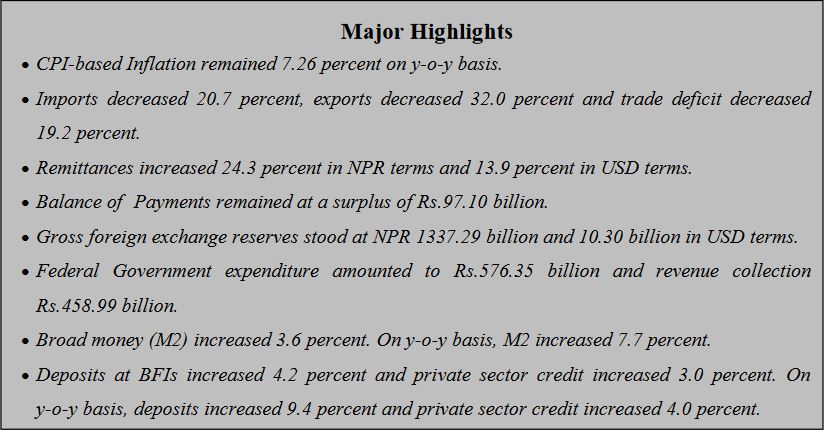

Publishing the Current Macroeconomic and Financial Situation of Nepal (based on six month data), the bank said that remittance inflows increased 24.3 percent to Rs.585.08 billion in the review period against a decrease of 5.0 percent in the same period of the previous year. In the US Dollar terms, remittance inflows increased 13.9 percent to 4.50 billion in the review period against a decrease of 5.7 percent in the same period of the previous year.

Number of Nepali workers (institutional and individual-new) taking approval for foreign employment increased 64.6 percent to 275,643 in the review period. The number of Nepali workers (Renew entry) taking approval for foreign employment increased 9.5 percent to 142,548 in the review period. It had increased 298.1 percent in the same period of the previous year, the bank says.

Net transfer increased 22.7 percent to Rs.644.72 billion in the review period. Such a transfer had decreased 4.4 percent in the same period of the previous year.

Current Account and Balance of Payments

The current account remained at a deficit of Rs.29.47 billion in the review period compared to a deficit of Rs.352.16 billion in the same period of the previous year. In the US Dollar terms, the current account registered a deficit of 233.3 million in the review period compared to deficit of 2.95 billion in the same period last year.

In the review period, capital transfer decreased 19.1 percent to Rs.4.43 billion and net foreign direct investment (FDI) remained Rs.749.4 million. In the same period of the previous year, capital transfer and net FDI amounted to Rs.5.48 billion and Rs.11.34 billion respectively.

Balance of Payments (BOP) remained at a surplus of Rs.97.10 billion in the review period compared to a deficit of Rs.241.23 billion in the same period of the previous year. In the US dollar terms, the BOP remained at a surplus of 734.4 million in the review period against a deficit of 2.02 billion in the same period of the previous year.

Foreign Exchange Reserves

Gross foreign exchange reserves increased 10.0 percent to Rs.1337.29 billion in mid-January 2023 from Rs.1215.80 billion in mid-July 2022.

In the US dollar terms, the gross foreign exchange reserves increased 8.0 percent to 10.30 billion in mid-January 2023 from 9.54 billion in mid- July 2022.

Of the total foreign exchange reserves, reserves held by NRB increased 12.0 percent to Rs.1183.37 billion in mid-January 2023 from Rs.1056.39 billion in mid-July 2022. Reserves held by banks and financial institutions (except NRB) decreased 3.4 percent to Rs.153.91 billion in mid-January 2023 from Rs.159.41 billion in mid-July 2022. The share of Indian currency in total reserves stood at 23.6 percent in mid-January 2023.

Foreign Exchange Adequacy Indicators

Based on the imports of six months of 2022/23, the foreign exchange reserves of the banking sector is sufficient to cover the prospective merchandise imports of 10.4 months, and merchandise and services imports of 9.1 months. The ratio of reserves-to-GDP, reserves-to- imports and reserves-to-M2 stood at 27.6 percent, 75.5 percent and 23.4 percent respectively in mid-January 2023. Such ratios were 25.1 percent, 57.8 percent and 22.1 percent respectively in mid-July 2022.

Merchandise Trade

During the six months of 2022/23, merchandise exports decreased 32.0 percent to Rs.80.81 billion against an increase of 95.5 percent in the same period of the previous year. Destination-wise, exports to India and China decreased 40.1 percent and 25.2 percent respectively whereas exports to other countries increased 3.6 percent.

Exports of zinc sheet, particle board, cardamom, woolen carpets, polyester yarn & thread, among others, increased whereas exports of soyabean oil, palm oil, oil cakes, textiles, silverware and jewelries, among others, decreased in the review period.

During the six months of 2022/23, merchandise imports decreased 20.7 percent to Rs.792.67 billion against an increase of 51.1 percent a year ago. Destination-wise, imports from India, China and other countries decreased 19.4 percent, 24.6 percent, and 21.4 percent respectively.

Imports of petroleum products, sponge iron, chemical fertilizer, gold, other stationeries, among others, increased whereas imports of transport equipment & parts, medicine, M.S. billet, silver, telecommunication equipments and parts, among others, decreased in the review period.

Full Text

Current-Macroeconomic-and-Financial-Situation-English-Based-on-Six-Months-data-of-2022.23