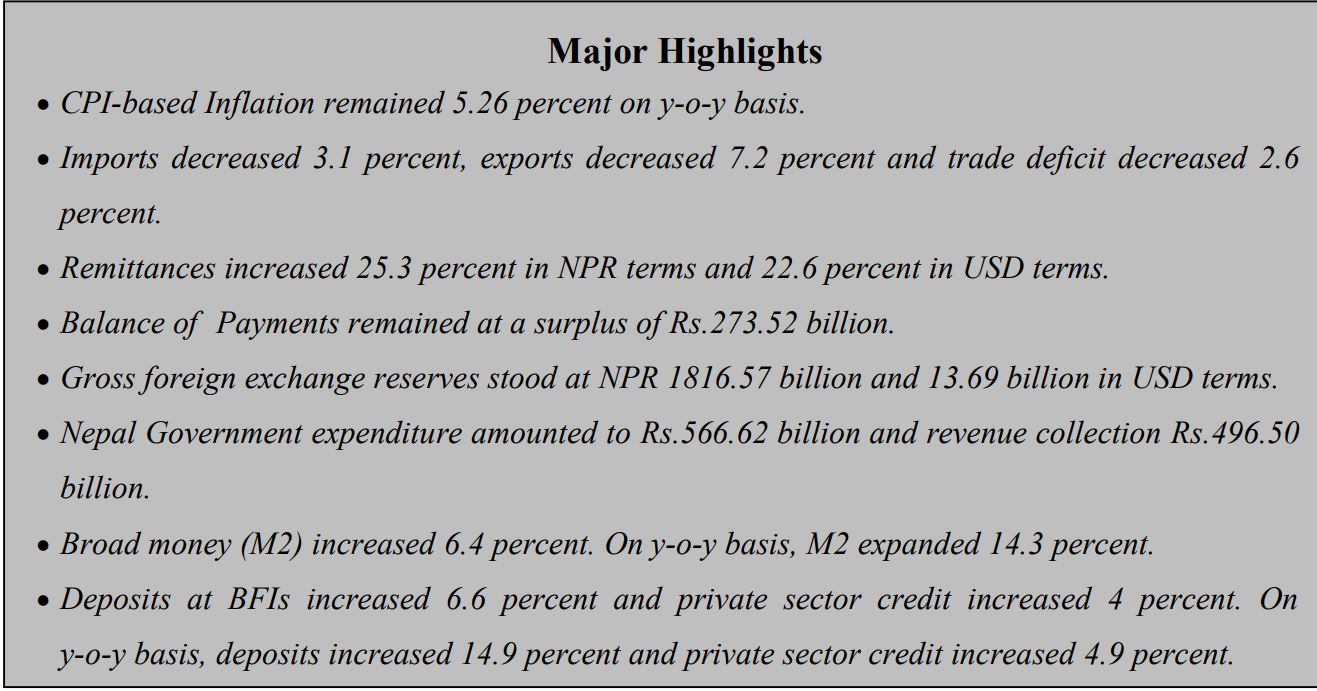

Kathmandu, Feb 6: The Nepal Rastra Bank (NRB), the central bank of Nepal, has said that the remittance inflows have increased 25.3 percent to Rs.733.22 billion in the review period compared to an increase of 24.3 percent in the same period of the previous year.

Publishing the Current Macroeconomic and Financial Situation of Nepal (based on six months data ending mid-January, 2023/24) today, NRB has said in the US Dollar terms, remittance inflows increased 22.6 percent to 5.52 billion in the review period compared to an increase of 13.9 percent in the same period of the previous year.

In the review period, the number of Nepali workers, both institutional and individual, taking firsttime approval for foreign employment stands at 207,970 and taking approval for renew entry stands at 135,435. In the previous year, such numbers were 275,643 and 142,548 respectively.

Net transfer increased 24 percent to Rs.799.51 billion in the review period. Such a transfer had increased 22.7 percent in the same period of the previous year.

Current Account and Balance of Payments

The current account remained at a surplus of Rs.161.62 billion in the review period against a deficit of Rs.35.57 billion in the same period of the previous year. In the US Dollar terms, the current account registered a surplus of 1.21 billion in the review period against a deficit of 279.6 million in the same period last year.

In the review period, capital transfer decreased 30 percent to Rs.3.11 billion and net foreign direct investment (FDI) remained a positive of Rs.4.53 billion. In the same period of the previous year, capital transfer amounted to Rs.4.43 billion and and net FDI amounted to Rs.749.4 million.

Balance of Payments (BOP) remained at a surplus of Rs.273.52 billion in the review period against a surplus of Rs.92.15 billion in the same period of the previous year. In the US Dollar terms, the BOP remained at a surplus of 2.06 billion in the review period against a surplus of 697.4 million in the same period of the previous year.

Foreign Exchange Reserves

Gross foreign exchange reserves increased 18.0 percent to Rs.1816.57 billion in mid-January 2024 from Rs.1539.36 billion in mid-July 2023. In the US dollar terms, the gross foreign exchange reserves increased 16.9 percent to 13.69 billion in mid-January 2024 from 11.71 billion in mid-July 2023.

Of the total foreign exchange reserves, reserves held by NRB increased 18.9 percent to Rs.1600.23 billion in mid-January 2024 from Rs.1345.78 billion in mid-July 2023.

Reserves held by banks and financial institutions (except NRB) increased 11.8 percent to Rs.216.35 billion in mid January 2024 from Rs.193.59 billion in mid-July 2023. The share of Indian currency in total reserves stood at 22.5 percent in mid- January 2024.

Foreign Exchange Adequacy Indicators

Based on the imports of six months of 2023/24, the foreign exchange reserves of the banking sector is sufficient to cover the prospective merchandise imports of 14.5 months, and merchandise and services imports of 12.1 months. The ratio of reserves-to-GDP, reserves-to-imports and reserves to-M2 stood at 33.8 percent, 100.9 percent and 27.7 percent respectively in mid-January 2024.

Such ratios were 28.6 percent, 83 percent and 25 percent respectively in mid-July 2023.

Composition of Foreign Trade

As per the Broad Economic Categories (BEC), the intermediate and final consumption goods accounted for 55.9 percent and 43.9 percent of the total exports respectively, whereas the ratio of capital goods in total exports remained negligible at 0.2 percent in the review period.

In the same period of the previous year, the ratio of intermediate, capital and final consumption goods remained 54.2 percent, 0.05 percent and 45.8 percent of total exports respectively.

On the imports side, the share of intermediate goods remained 49.2 percent, capital goods 8.7 percent and final consumption goods 42.1 percent in the review period. Such ratios were 53.1 percent, 8.8 percent and 38.1 percent respectively in the same period of the previous year.

Export-Import Price Index

The y-o-y unit value export price index, based on customs data, increased 5.7 percent whereas the import price index decreased 2.8 percent. As a result, the terms of trade (ToT) index increased 8.7 percent in the review period.

Consumer Price Inflation (CPI)

The y-o-y consumer price inflation moderated to 5.26 percent in mid-January 2024 compared to 7.26 percent a year ago. Food and beverage category inflation stood at 5.77 percent whereas non-food and service category inflation stood at 4.85 percent in the review month.

The y-o-y price index of ghee & oil, vegetables, meat & fish and transportation sub-categories exhibited a downward trend in mid-January 2024. Additionally, price index of spices and sugar & sugar products are also moderating.

During the review month, the y-o-y import price index, salary and wage rate index and the wholesale price index also moderated. These factors contributed to a moderated consumer price inflation.

Full Text

Current Macroeconomic and Financial Situation - English (Based on Six Months' data of 2023.24)