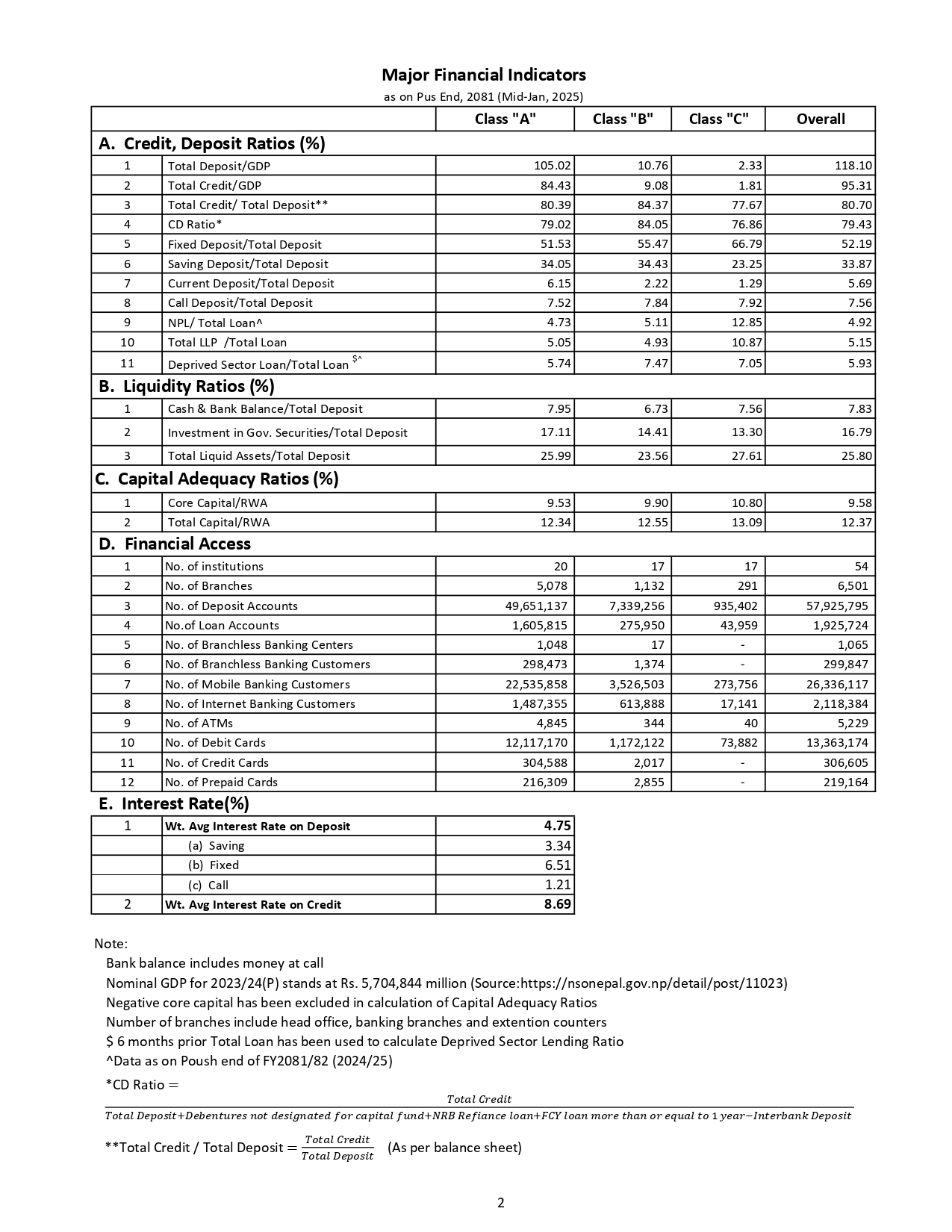

Kathmandu, Feb 11: The latest report on Nepal’s financial sector reveals key banking statistics as of mid-January 2025. The report covers Class “A” (commercial banks), Class “B” (development banks), and Class “C” (finance companies), providing insights into their performance in credit, liquidity, capital adequacy, and financial access.

Credit and Deposit Ratios:

– Total deposits as a percentage of GDP stand at 118.10%, with Class “A” banks contributing the highest at 105.02%.

– The overall total credit to GDP ratio is 95.31%, indicating a significant volume of loans in the economy.

– Credit to total deposit ratio remains at 80.70% across all institutions, reflecting steady lending activity.

Liquidity Ratios:

– Cash and bank balance to total deposit ratio is 7.83%, while investment in government securities stands at 16.79% of total deposits, indicating strong liquidity management by banks.

– Total liquid assets to total deposits ratio is 25.80%, ensuring sufficient liquidity to meet obligations.

Capital Adequacy:

– The capital to risk-weighted assets ratio (CRAR) for all institutions averages 12.37%, with Class “C” institutions maintaining the highest ratio at 13.09%.

Financial Access:

– The financial sector comprises 54 institutions, including 20 commercial banks, 17 development banks, and 17 finance companies.

– The total number of deposit accounts has reached 57.92 million, while loan accounts stand at 1.92 million.

– Mobile banking services have seen significant growth, with 26.33 million customers using mobile platforms for financial transactions.

– There are 5,229 ATMs across the country, supporting increased access to banking services, debit card reached 13.36 million and credit card holders reached 306,605.

Interest Rates:

– The weighted average interest rate on deposits is 4.75%, with fixed deposits earning an average interest rate of 6.51%.

– The average interest rate on loans stands at 8.69%, reflecting the cost of borrowing in the current market.

The report highlights the continued expansion of financial services, with mobile and internet banking customers surpassing 28.45 million. The increasing adoption of digital services demonstrates the sector’s progress in enhancing accessibility and convenience for customers across the country.

Full Report