Jugal K Kushwaha*

Digital Currency

Digital Currency is a specific type of electronic currency with specific properties. It is in the form of digital money, electronic money or electronic currency. Digital currency is a type of any currency, money or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the internet. It exhibits properties similar to traditional currencies, but generally do not have a physical form, unlike currencies with printed banknotes or minted coins.

Different agencies and regulators define different and often conflicting meanings for the different types of digital currency based on the specific properties of a specific currency type or sub-type. Some of governmental jurisdictions have implemented their own unique definition for digital currency, virtual currency, cryptocurrency, e-money, network money, e-cash, and other types of digital currency. Some of the definitions are:

European Central Bank- “A virtual currency is a type of unregulated, digital money, which is issued and usually controlled by its developers, and used and accepted among the members of a specific Virtual community “.

The US Department of Treasury- “A virtual currency is a medium of exchange that operates like a currency in some environments, but does not have all the attributes of real Currency”. The US Department of Treasury also stated that, “Virtual currency does not have legal-tender status in any jurisdiction.”

Bank for International Settlements- A virtual currency is an asset represented in digital form and having some monetary characteristics.

Cryptocurrency is a sub-type of digital currency and a digital asset that relies on cryptography to chain together digital signatures of asset transfers, peer-to-peer networking and decentralization.

The term cryptocurrencies come from the cryptographic processes that developers have put in place to guard against fraud.

Cryptocurrencies can allow electronic money systems to be decentralized. When implemented with a block chain, the digital ledger system or record keeping system uses cryptography to edit separate shards of database entries that are distributed across many separate servers. Block chain central to the appeal and functionality of Bitcoin and other cryptocurrencies is block chain technology. As its name indicates, block chain is essentially a set of connected blocks or an online ledger. Each block contains a set of transactions that have been independently verified by each member of the network. Every new block generated must be verified by each node before being confirmed, making it almost impossible to forge transaction histories. The contents of the online ledger must be agreed upon by the entire network of an individual node, or computer maintaining a copy of the ledger. Experts say that block chain technology can serve multiple industries, such as supply chain, and processes such as online voting and crowdfunding. Financial institutions such as JPMorgan Chase & Co. (JPM) are testing the use of block chain technology to lower transaction costs by streamlining payment processing.

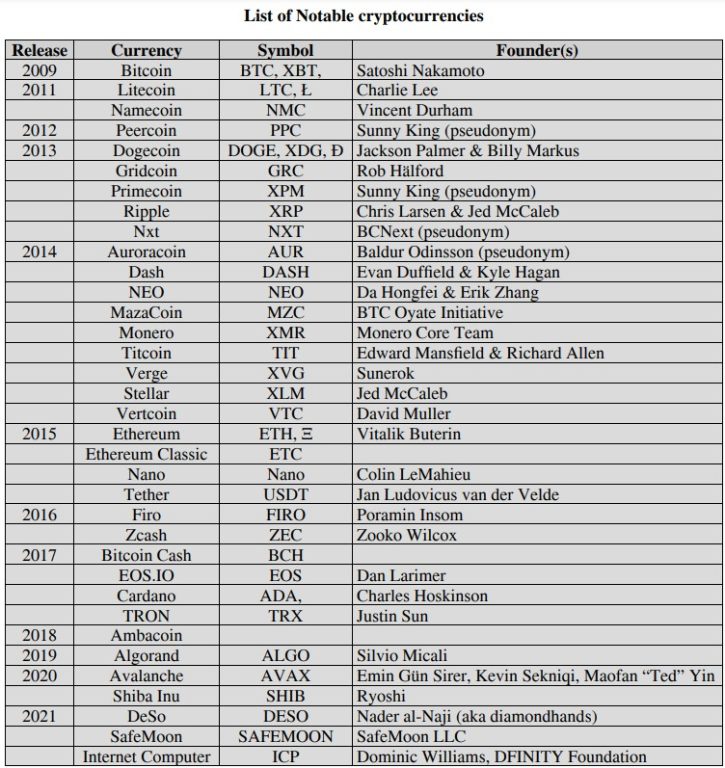

Some of the major notable cryptocurrencies are:

Mining cryptocurrency

The first and most popular system is bitcoin, a peer-to-peer electronic monetary system based on cryptography. These innovations addressed a problem faced by previous efforts to create purely digital currencies: how to prevent people from making copies of their holdings and attempting to spend them twice. Cryptocurrencies are digital assets created using computer networking software that enables secure trading and ownership. One common way cryptocurrencies are created is through a process known as mining, which is used by Bitcoin. Mining can be an energy-intensive process in which computers solve complex puzzles in order to verify the authenticity of transactions on the network. As a reward, the owners of those computers can receive newly created cryptocurrency. Other cryptocurrencies use different methods to create and distribute tokens, and many have a significantly lighter environmental impact.

Mining cryptocurrency is generally only possible for a proof-of-stake cryptocurrency such as Bitcoin. And before we get too far, it is worth noting that the barriers to entry can be high and the probability of success relatively low without major investment. While early Bitcoin users were able to mine the cryptocurrency using regular computers, the task has gotten more difficult as the network has grown. Now, most miners use special computers whose sole job is to run the complex calculations involved in mining all day every day. And even one of these computers isn’t going to guarantee you success. Many miners use entire warehouses full of mining equipment in their quest to collect rewards. If you don’t have the resources to compete with the heavy hitters, one option is joining a mining pool, where users share rewards. This reduces the size of the reward you’d get for a successful block, but increases the chance that you could at least get some return on your investment.

Legality of cryptocurrencies

There’s no question that cryptocurrencies are legal in the U.S., though China has essentially banned their use, and ultimately whether they’re legal depends on each individual country.

The question of whether cryptocurrencies are allowed, however, is only one part of the legal question. Other things to consider include how crypto is taxed and what you can buy with cryptocurrency.

Legal tender: You might call them cryptocurrencies, but they differ from traditional currencies in one important way: there’s no requirement in most places that they be accepted as “legal tender.” The U.S. dollar, by contrast, must be accepted for “all debts, public and private.”

Countries around the world are taking various approaches to cryptocurrency. El Salvador in 2021 became the first country to adopt Bitcoin as legal tender. Meanwhile, China is developing its own digital currency. For now, in the U.S., what you can buy with cryptocurrency depends on the preferences of the seller.

Crypto taxes: Again, the term “currency” is a bit of a red herring when it comes to taxes in the U.S. Cryptocurrencies is taxed as property, rather than currency. That means that when you sell them, you’ll pay tax on the capital gains, or the difference between the price of the purchase and sale. And if you’re given crypto as payment or as a reward for an activity such as mining. You’ll be taxed on the value at the time you received them. The Indian budget has recently made provision of taxes on cryptocurrency transaction.

Cryptocurrency inspires passionate opinions across the spectrum of investors. Here are a few reasons that some people believe it is a transformational technology, while others worry it’s a fad.

Cryptocurrency pros

- Supporters see cryptocurrencies such as Bitcoin as the currency of the future and are racing to buy them now, presumably before they become more valuable.

- Some supporters like the fact that cryptocurrency removes central banks from managing the money supply since over time these banks tend to reduce the value of money via inflation.

- Other advocates like the block chain technology behind cryptocurrencies, because it’s a decentralized processing and recording system and can be more secure than traditional payment systems.

- Some speculators like cryptocurrencies because they’re going up in value and have no interest in the currencies’ long-term acceptance as a way to move money.

Some cryptocurrencies offer their owners the opportunity to earn passive income through a process called staking. Crypto staking involves using your cryptocurrencies to help verify transactions on a block chain protocol. Though staking has its risks, it can allow you to grow your crypto holdings without buying more.

Cryptocurrency cons

- Many cryptocurrency projects are untested, and block chain technology in general has yet to gain wide adoption. If the underlying idea behind cryptocurrency does not reach its potential, long-term investors may never see the returns they hoped for.

- For shorter-term crypto investors, there are other risks. Its prices tend to change rapidly, and while that means that many people have made money quickly by buying in at the right time, many others have lost money by doing so just before a crypto crash.

- Those wild shifts in value may also cut against the basic ideas behind the projects that cryptocurrencies were created to support.

For example, people may be less likely to use Bitcoin as a payment system if they are not sure what it will be worth the next day. - The environmental impact of Bitcoin and other projects that use similar mining protocols is significant. A comparison by the University of Cambridge, for instance, said worldwide Bitcoin mining consumes more than twice as much power as all U.S. residential lighting. Some cryptocurrencies use different technology that demands less energy.

- Governments around the world have not yet fully reckoned with how to handle cryptocurrency, so regulatory changes and crackdowns have the potential to affect the market in unpredictable ways.

Cryptocurrencies were introduced with the intent to revolutionize financial infrastructure. As with every revolution, however, there are tradeoffs involved. At the current stage of development for cryptocurrencies, there are many differences between the theoretical ideal of a decentralized system with cryptocurrencies and its practical implementation. Some advantages and disadvantages of cryptocurrencies are as follows.

Advantages

- Cryptocurrencies represent a new, decentralized paradigm for money. In this system, centralized intermediaries, such as banks and monetary institutions, are not necessary to enforce trust and police transactions between two parties. Thus, a system with cryptocurrencies eliminates the possibility of a single point of failure, such as a large bank, setting off a cascade of crises around the world, such as the one that was triggered in 2008 by the failure of institutions in the United States.

- Cryptocurrencies promise to make it easier to transfer funds directly between two parties, without the need for a trusted third party like a bank or a credit card company. Such decentralized transfers are secured by the use of public keys and private keys and different forms of incentive systems, such as proof of work or proof of stake.

- Because they do not use third-party intermediaries, cryptocurrency transfers between two transacting parties are faster as compared to standard money transfers. Flash loans in decentralized finance are a good example of such decentralized transfers. These loans, which are processed without backing collateral, can be executed within seconds and are used in trading.

- Cryptocurrency investments can generate profits. Cryptocurrency markets have skyrocketed in value over the past decade, at one point reaching almost $2 trillion. As of Dec. 20, 2021, Bitcoin was valued at more than $862 billion in crypto markets.

- The remittance economy is testing one of cryptocurrency’s most prominent use cases. Currently, cryptocurrencies such as Bitcoin serve as intermediate currencies to streamline money transfers across borders. Thus, a fi at currency is converted to Bitcoin (or another cryptocurrency), transferred across borders and, subsequently, converted to the destination fi at currency. This method streamlines the money transfer process and makes it cheaper.

Disadvantages

- Though they claim to be an anonymous form of transaction, cryptocurrencies are actually pseudonymous. They leave a digital trail that agencies such as the Federal Bureau of Investigation (FBI) can decipher. This opens up possibilities of governments or federal authorities tracking the financial transactions of ordinary citizens.

- Cryptocurrencies have become a popular tool with criminals for nefarious activities such as money laundering and illicit purchases. The case of Dread Pirate Roberts, who ran a marketplace to sell drugs on the dark web, is already well known. Cryptocurrencies have also become a favorite of hackers who use them for ransomware activities.

- In theory, cryptocurrencies are meant to be decentralized, their wealth distributed between many parties on a block chain. In reality, ownership is highly concentrated. For example, an MIT study found that just 11,000 investors held roughly 45% of Bitcoin’s surging value.

- One of the conceits of cryptocurrencies is that anyone can mine them using a computer with an Internet connection. However, mining popular cryptocurrencies requires considerable energy, sometimes as much energy as entire countries consume. The expensive energy costs coupled with the unpredictability of mining have concentrated mining among large fi rms whose revenues running into the billions of dollars. According to an MIT study, 10% of miners account for 90% of its mining capacity.

- Though cryptocurrency block chains are highly secure, other crypto repositories, such as exchanges and wallets, can be hacked. Many cryptocurrency exchanges and wallets have been hacked over the years, sometimes resulting in millions of dollars’ worth of coins” stolen.

- Cryptocurrencies traded in public markets suffer from price volatility. Bitcoin has experienced rapid surges and crashes in its value, climbing to as high as $17,738 in December 2017 before dropping to $7,575 in the following months. Some economists thus consider cryptocurrencies to be a short-lived fad or speculative bubble.

Conclusion

A cryptocurrency is a form of digital asset based on a network that is distributed across a large number of computers. This decentralized structure allows them to exist outside the control of governments and central authorities. Experts believe that block chain and related technology will disrupt many industries, including finance and law. The advantages of cryptocurrencies include cheaper and faster money transfers and decentralized systems that do not collapse at a single point of failure. The disadvantages of cryptocurrencies include their price volatility, high energy consumption for mining activities, and use in criminal activities. Virtual currencies pose challenges for central banks, financial regulators, departments or ministries of finance, as well as fiscal authorities and statistical authorities.

Many existing digital currencies have not yet seen widespread usage, and may not be easily used or exchanged. Banks generally do not accept or offer services for them. There are concerns that cryptocurrencies are extremely risky due to their very high volatility and potential for pump and dump schemes. Regulators in several countries along with Nepal have warned against their use and some have taken concrete regulatory measures to dissuade users. The non-cryptocurrencies are all centralized. As such, they may be shut down or seized by a government at any time. (This article was originally published at NRB’s Annual Souvenir-2079 BS)

The writer is Deputy Director at Nepal Rastra Bank (NRB)