Kathmandu, June 9: The Nepal Rastra Bank (NRB) has said that the remittance inflows increased 23.4 percent to Rs.1005.18 billion in the review period compared to an increase of 0.5 percent in the same period of the previous year.

According to the Current Macroeconomic and Financial Situation of Nepal (based on 10 months’ data ending mid-May, 2023) released by the Nepal Rastra Bank (NRB) today, in the US Dollar terms, remittance inflows increased 13.4 percent to 7.70 billion in the review period against a decrease of 1.2 percent in the same period of the previous year.

Number of Nepali workers (institutional and individual–new) taking approval for foreign employment increased 51.4 percent to 421,279 in the review period. The number of Nepali workers (Renew entry) taking approval for foreign employment increased 3.7 percent to 238,976 in the review period. It had increased 185.5 percent in the same period of the previous year.

Net transfer increased 22.5 percent to Rs.1110.22 billion in the review period. Such a transfer had increased 0.3 percent in the same period of the previous year, the bank said.

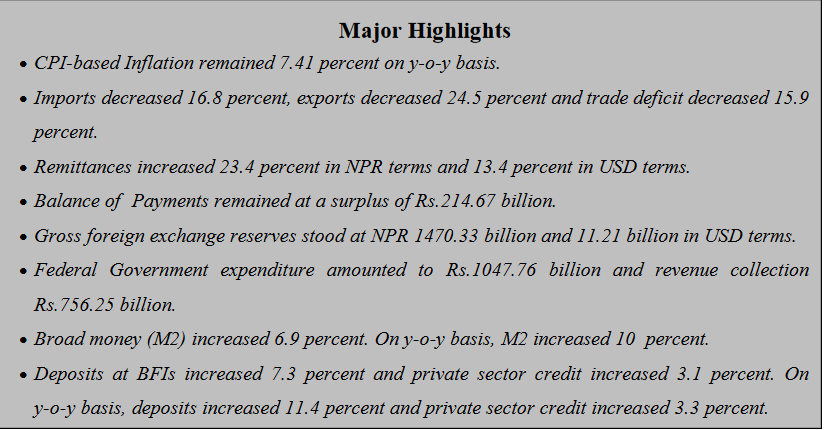

Likewise, the year-on-year consumer price inflation has remained at 7.41 percent in 10 months of the current fiscal year, 2022/23. This is against the government’s target to keep consumer price inflation within the limit of seven percent, and against 7.87 percent during the same period in the previous FY, 2021/22.

Similarly, Balance of Payments remained at a surplus of Rs 214.67 billion in the review period as opposed to a deficit of Rs 288.50 billion in the same period of the previous FY.

Gross foreign exchange reserves increased 20.9 percent to Rs 1470.33 billion as compared to Rs 1215.80 billion during the same period in the previous FY. In the US dollar terms, the gross foreign exchange reserves surged 17.6 percent to 11.21 billion from 9.54 billion. Broad money increased 6.9 percent as compared to an increase of 3.8 percent in the corresponding period of the previous FY. On year-on-year, broad money expanded 10.0 percent.

Total trade deficit decreased 15.9 percent to Rs 1204.42 billion against an increment of 24.9 percent in the same period of the previous FY.

Total expenditure of the federal government has remained at Rs 1047.76 billion. The recurrent expenditure, capital expenditure and financial management expenditure amounted to Rs 786.74 billion, Rs 125.68 billion and Rs 135.34 billion respectively.

Likewise, deposits at Banks and Financial Institutions (BFIs) increased 7.3 percent to Rs 370.78 billion as opposed to a five percent increment to Rs 231.32 billion in the corresponding period of the previous FY. On year-on-year basis, deposits at BFIs expanded 11.4 percent.

Private sector credit from BFIs surged 3.3 percent to Rs 153.17 billion as compared to a 13.4 percent increment to Rs 548.14 billion in the same period of the previous FY. On year-on-year basis, credit to the private sector from BFIs increased 3.1 percent.

Current Macroeconomic and Financial Situation - English (Based on Ten Months data of 2022.23) final