Ramesh C. Paudel/Tara Prasad Bhusal

Workers’ remittance has been a common phenomenon of Nepalese economy for almost two decades now. The data shows that the volume of remittances inflows is about 30 percent of Nepal’s gross domestic products (GDP), on average, with some fluctuations.

Notably, the inflows of remittances have increased since 2002 and it has become an indispensable part of national economy. Imports seem to have a surged since around the same time indicating the imports have been fed by remittances. Normally, as the money circulation increases in the households, it is expected that it contributes to increase the entrepreneurship in the society. On the other hand, the source of remittance is out migrant youths from the country and it causes to lose the production forces in the national economy, so country starts becoming the importer rather than exporter in the international market.

Nepal’s export performance has not met the expectation of the stakeholders, and no doubt neither of policy makers, despite various policy reforms and efforts. In the policy reforms, Nepal adopted the World Trade Organization (WTO) guidelines and notably Nepal is known as one of the earlier entrants in the liberalization and reform era in the South Asian region, but the progress is very slow. Many supporting environments are made.

Tariffs are comparatively lower than that of the neighbors’, good sized markets in the neighbors, suitable climate and better weather for varieties of entrepreneurship, and cheap labor forces in the countries but all of these have not turned into favorable for exports yet. This study econometrically investigates a gravity model using annual data of export from Nepal to its partner countries for the period of 26 years, that is, from 1993-2018.

Here, we understand the limit of country specific studies such as this one, but we believe that it can provide a benchmark policy guiding for other many countries that pass from similar phase of export trade. Also, we note that knowing the real contribution of the remittance inflows in the export performance of Nepal itself would be a good contribution in policy inferences perspectives.

Our findings from this study suggest that remittances have a negative impact in the export performance of Nepal. In this regard, we should be aware that the remittances may have positive impact in economic activities from other channel, such as, imports, foreign currencies’ role in the economy, money circulation, government revenues and so on.

Also, the results suggest that exporting to the large economy, rather than to large markets, would help to enhance the export performance of Nepal. The results indicate that a proper coordination between export destination and exportable products may be a good export strategy so that Nepal export’s level would be higher. These findings may be of interest for other landlocked developing countries that face the same geographical constraints as of Nepal.

REMITTANCES AND EXPORT PERFORMANCE

The role of remittances on export performance is analyzed in this section looking the trends of these variables over the study period. For this purpose, three important data and their relationships are important. First, how remittances and exports are recorded over the period.Second, remittances and exports share in terms of GDP to explore the contribution of these two economic variables in Nepal’s GDP. Third, we want to observe Nepal’s remittances inflows and exports, while comparing them with the World’s respectively.

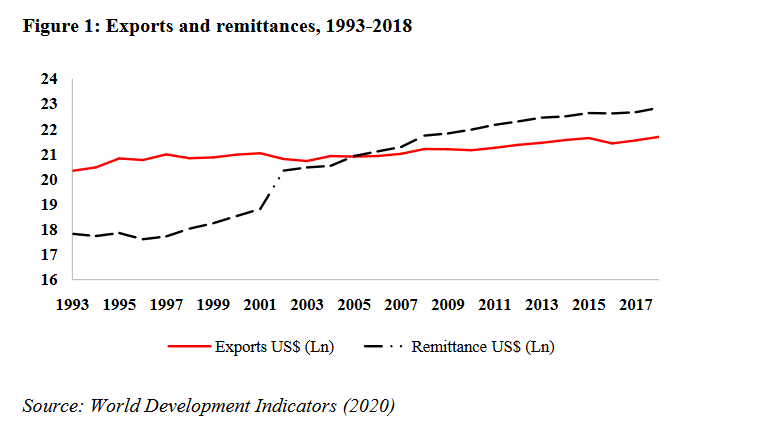

The natural log values of Nepal’s exports and remittances inflows both measured in the United States Dollar (USD) for the duration from 1993 to 2018. This figure provides us three important information. First, Nepal’s remittances have stronger inclining trend than that of exports. Second, until 2005, Nepal’s exports values were higher than that of remittances inflows. Third, even if we look after 2005 period, we see the gap between exports values and remittances inflows is widening in the recent years. The sharpest incline of the remittances was recorded in between 2001 to 2002, when the political turmoil was in the peak.

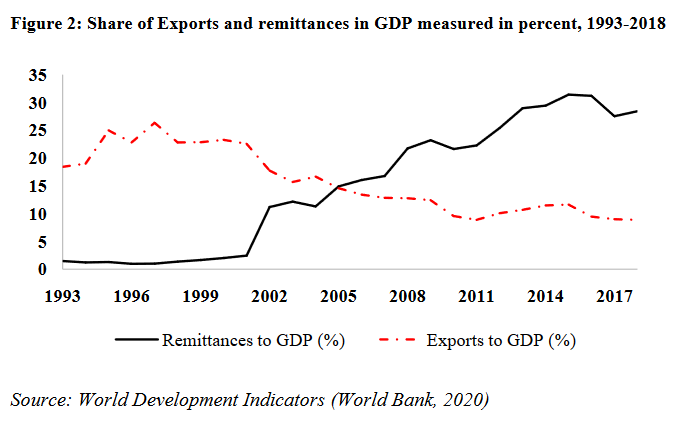

We present the share of remittances and exports in GDP measured in percent for the same period. We find the declining trend of the share of exports over the period, particularly after 1997 when it reached to about 26 percent, recording just about nine percent in 2018. Exports started losing its ground to remittances since 2005 and the remittances share in GDP is leading with the widening gap with the exports share in GDP. For the later period, it is clearly seen that the exports and remittances are almost going in opposite direction or we can say have expressed an opposite behavior. The share of remittances in GDP went up to over 31 percent in 2015 and 2016 and has remained around 28 percent since then.

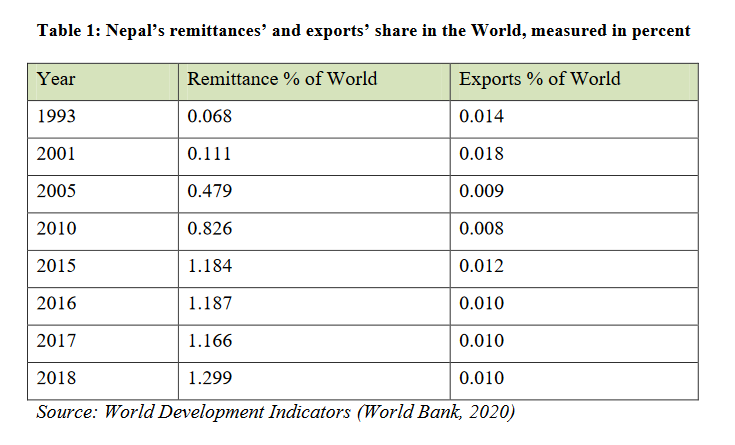

Due to very small figures of Nepal’s export’s share in the World’ exports, we preferred to put these data in a table as presented in Table 1, which shows a comparison of Nepal’s remittances and exports with the world’s remittances and exports respectively. The data show that Nepal’s remittances share in the World’s remittances is increasing over the period from about 0.07 percent to 1.30 percent, while the story of exports largely seem to stagnant, such as, the share of exports was recorded 0.015 percent in 1993 that comes down to 0.010 percent. Another important point to note is that the share of exports was highest in 2001 but just 0.018 percent, then it started declining sharply. Without surprise as mentioned earlier, the remittances share started increasing from the same year. In every selected year, the share of remittances of Nepal compared to that of the remittances of the World has increased visibly.

CONCLUSION

Role of workers’ remittance seems to be an indispensable part of Nepalese economy for about one and half decades. The remittances inflow has supported to maintain the foreign reserves at the national level and consumption in household level.

The major findings of this research indicate that the role of remittances seems, as indicated by the results, to be negative for export performance. Specially, the case of remittance seems to be related with the Dutch disease story. Relying on remittances instead of employing the youth forces in the country, particularly in the manufacturing sector, adversely impacts the export performance and stimulates the imports. The major policy inferences from the study are that it may be a good idea to focus to trade with large and rich economies for the better performance of the exports.

There is an urgent need to connect the remittance with the entrepreneurships rather than just feeding the imports, and the export strategies should be supported by the remittance management strategies.

Also, the study suggests for an urgent attention from policy makers to make the remittance in favor of exports by developing the export strategies. One idea can be managing some provision of compulsory investment in the productive sector from the remittances to motivate the exports related manufacturing sectors. In this regard, a special focus to export to the rich economies may be a good way to boost the export performance of Nepal, and this is in line with the high-value-to-weight product’s story.

—

Ramesh C. Paudel: Associate Professor, Central Department of Economics, Tribhuvan University, Kirtipur, Kathmandu, Nepal. Email: [email protected]

Tara Prasad Bhusal: Professor, Central Department of Economics, Tribhuvan University, Kirtipur, Kathmandu, Nepal.

(This research article was first appeared in Nepal Rastra Bank, the central bank of Nepal. https://t.co/KXyeta2Kyr?amp=1)